Life Insurance for BenzaClin users.

In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed BenzaClin or its generic form, which consists of two different medications, Benzoyl Peroxide and Clindamycin to help one treat acne.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed BenzaClin?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed BenzaClin?

Yes, individuals who have been prescribed BenzaClin can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, during the application process, there is very little chance that the fact that you have been prescribed this medication will even be mentioned by your life insurance agent or the life insurance underwriter assigned to your application.

In truth…

The only time this medication ever seems to be mentioned during a life insurance application is an individual becomes a bit “overly” nervous about the whole life insurance application process. Particularly if they’re really healthy and now they’re wondering if their “acne medication” will mess up their chances of qualifying for the best possible life insurance rate.

And…

Who can blame them, after all, it’s not like the average person is going to know all that much about the underwriting guidelines of most life insurance companies, and most of us are probably going to think the worst until the whole process is over….!

Which is why…

We wrote this article about applying for life insurance after being prescribed BenzaClin and why we wanted to try and shed some additional light on what the “process” of applying for life insurance will look like as well as give some rationale about why the insurance companies as the questions that they do.

What kind of information will the insurance companies ask me or be interested in?

On a life insurance application, there isn’t a wasted question. Meaning that every question they are going to ask you is designed to determine what kind of “risk” you will pose to them should they decide to approve your application.

Some…

Of the questions will focus on your health, while others will focus on the health of those related to you as well as certain “lifestyle choices” that you have made or plan to make in the future which could potentially make you a greater risk to them. Because, remember, if an insurance company decides to offer you a policy, that policy will be in effect for many years to come so they really only have one chance to get it right!

This is why…

They ask so many questions and why some of the questions may seem weird at first. With that said, let’s take a look at some of the most common questions you’ll like be asked including:

- What is your date of birth?

- What are your current height and weight?

- Have you ever been diagnosed with any pre-existing medical conditions such as cancer, heart disease, stroke, or diabetes?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with any serious pre-existing medical conditions such as cancer, heart disease, stroke, or diabetes?

- Aside from BenzaClin, are you taking any other prescription medications?

- In the past 12 months, have you used any tobacco or nicotine products?

- Do you have any issues with your driver’s license? Issues such as multiple moving violations, DUI or a suspended license?

- Do you currently participate or plan to participate in and dangerous hobbies?

- Do you have any set plans to travel outside of the United States in the next year or so?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

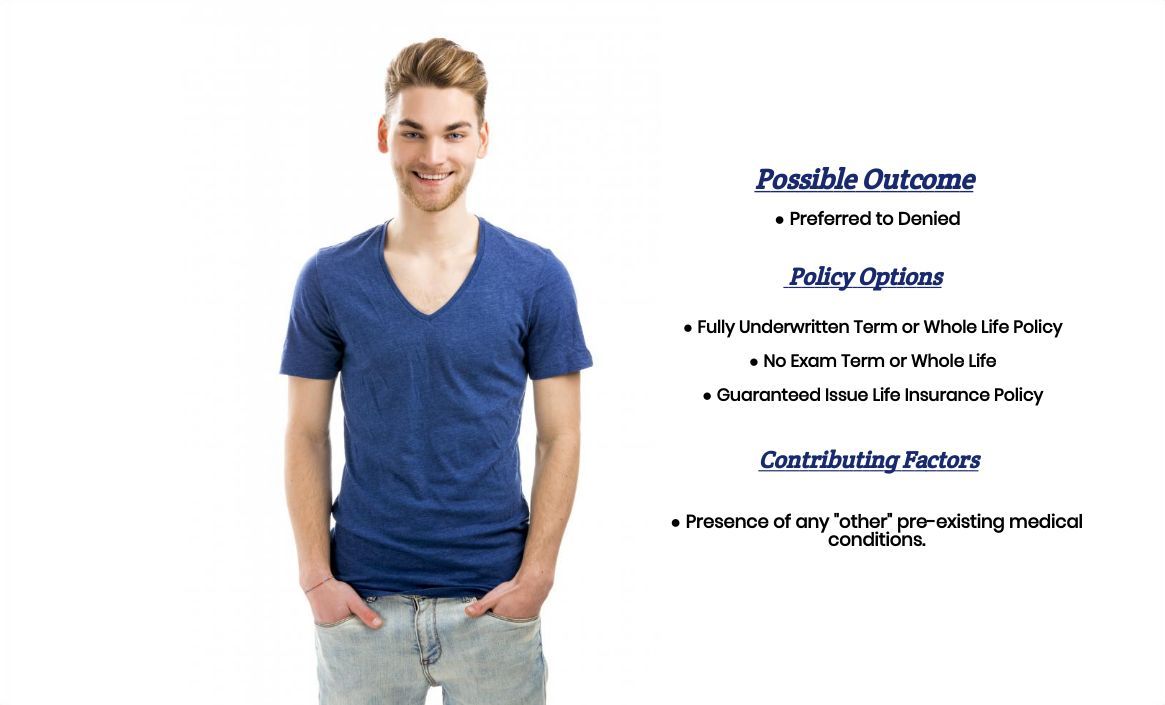

As we’ve stated before, the fact that you’ve been prescribed BenzaClin isn’t going to have any effect on the outcome of your life insurance application what so ever. But as we just listed above, there are a ton of other factors that could come into play that can potentially have a significant effect on the outcome of your life insurance application.

Which is why we wanted to end this article by taking a moment and focus on…

What can I do to help ensure that I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who the will and won’t insure, and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients can find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see…

By only employing true life insurance professionals who have tons of experience helping folks with all sorts of pre-existing medical conditions and then providing them with tons of options to offer their clients, we here at IBUSA truly offer a one-stop-shop for folks looking to protect their family.

Which is why…

Our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that he or she has dozens of options for you to consider including many of the current no medical exam life insurance options that may be available to you.

Because remember…

Even if you’ve found the greatest life insurance agent in the world, if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

Now, will we be able to help out everyone who has been prescribed Benzaclin?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well.

This way…

If someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!