In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Androgel or its generic form, Testosterone, to help folks who have been diagnosed with decreased testosterone levels.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Androgel?

- Why do life insurance companies care if I’ve been prescribed Androgel?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Androgel?

In most cases, being prescribed Androgel will not affect the outcome of your life insurance application. In other words, if you’re healthy enough to qualify for a traditional term or whole life insurance policy, having been prescribed Androgel in the past will not change that! Some may even qualify for some of the best no-medical-exam life insurance policies at a Preferred rate!

This is because…

Unlike many other prescription medications that can be used to treat a wide variety of medical conditions, Androgel is only used to help supplement one’s natural levels of Testosterone to an average level. This leads us to our next question, which is…

Why do life insurance companies care if I’ve been prescribed Androgel?

While it’s true that most of the top-rated life insurance companies aren’t all that concerned with the fact that an individual has been prescribed Androgel, they can become concerned, however, if its prescription is being used to help mitigate symptoms associated with a more serious medical condition which could be causing one to need to receive testosterone supplements.

You see…

Androgel typically isn’t a medication that is prescribed to individuals suffering from a normal, age-related decrease in testosterone levels. Instead, Androgel is usually prescribed to someone who has been diagnosed with hypogonadism or to someone who may be experiencing a decline in their testosterone levels as a result of some medication that they are taking (i.e., chemotherapy) or problems with their pituitary gland.

This is why…

In “most cases,” having been prescribed Androgel isn’t going to be an issue when applying for a traditional term or whole life insurance policy, but sometimes it can. And because it can sometimes become “quite an issue,” what you’re going to find typically is that before being approved for a traditional term or whole life insurance policy, most (if not all) life insurance underwriters are going to want as a few questions before making any decision about your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

The main thing an insurance company is going to be interested in when it comes to Androgel prescription is its

“Why have you been prescribed Androgel?”

And…

“Is there some underlying medical condition they should be worried about?”

From there, you’re either going to be told that your Androgel prescription isn’t going to play a role in the outcome of your life insurance application, or you’re going to be inundated with a series of questions all designed to learn more about the underlying cause that prompted your doctor to prescribe your Androgel in which case; all bets are off as to whether or not you’re going to be able to qualify for a traditional term or whole life insurance policy.

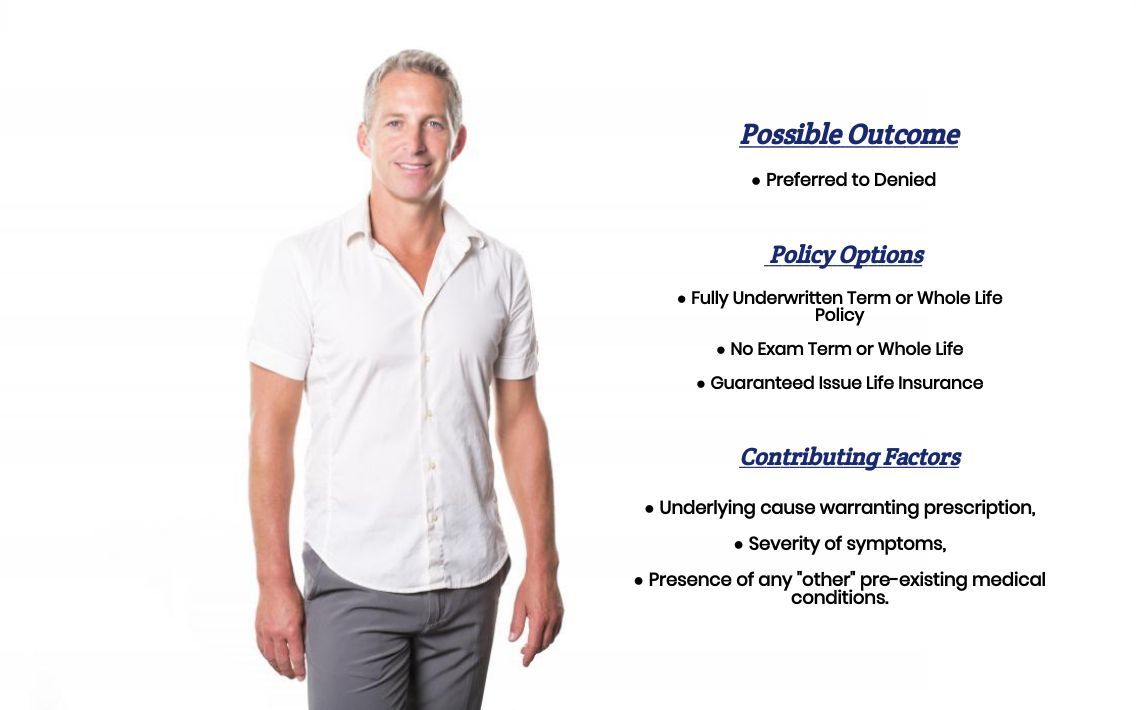

What rate (or price) can I qualify for?

As a general rule of thumb, provided that you haven’t been diagnosed with some serious medical condition that has caused your testosterone levels to drop below normal, we here at IBUSA have found that most Androgel recipients can and often will be able to qualify for a Preferred or Preferred Plus rate provided that they would otherwise be able to qualify for such a rate.

Now, as for…

For those who have been prescribed Androgel as a way to treat a low testosterone symptom caused by some more significant, more serious medical condition, that underlying pre-existing medical condition will mostly be the most important determining factor affecting the outcome of your life insurance application.

This brings us to the next section we wanted to discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, what works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a proper life insurance professional who will work as an advocate for them. Such an agent will be able to help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly, before applying for coverage, you should be completely honest with your life insurance agent. By doing so, you will help them narrow down what options might be the “best. “

Now, can we help out everyone who has been prescribed Androgel?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies.

This way, if someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!