In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been diagnosed with an Atrioventricular Block (AV Block).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with an atrioventricular block?

- Why do life insurance companies care if I’ve been diagnosed with an atrioventricular block?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been diagnosed with an atrioventricular block?

Yes, individuals who have been diagnosed with an atrioventricular block can and often will be able to qualify for a traditional term or whole life insurance policy. The only problem is that because there are “degrees of blockage” that an individual can suffer from, simply knowing that an individual has been diagnosed with an atrioventricular block won’t be enough to know for sure whether or not an individual will be able to qualify for a traditional life insurance policy.

This is also why…

Even though it might be tempting to try to apply for a No Medical Exam Term or Whole Life Insurance policy, we here at IBUSA will usually advise against doing so if you have been previously diagnosed with an atrioventricular blockage because in most cases folks with an AV block will be automatically denied.

Why do life insurance companies care if I’ve been diagnosed with an atrioventricular block?

Generally, it’s safe to assume that any time that you’ve been diagnosed with a pre-existing medical condition having to do with the heart, most (if not all) of the top-rated life insurance companies that most folks are familiar with are going to “care” about it.

And…

In the case of being diagnosed with an atrioventricular block, this is certainly the case. Now, probably the best way to understand “why” a life insurance company is going to “care” about the fact that you have been diagnosed with an atrioventricular block is first to take a look at exactly what an atrioventricular block is and discuss how it can potentially affect your overall health.

Atrioventricular Block Defined.

An atrioventricular block is a term used to describe a condition in which an individual is suffering from either a partial or complete interruption of the electrical transmission or electrical impulses traveling from the atria to the ventricles, which govern how one’s heart will beat.

Depending on the severity of one’s “blockage,” one will usually be diagnosed with a “type” or “degree” of atrioventricular blockage, which will play a significant role in determining the outcome of one’s life insurance application.

Types of Atrioventricular blockage:

- First-Degree AV Blockage:

-

- It is defined as a “slowing” of the electrical transmissions from the atria to the ventricles, whereby there ISN’T an actual skipping of the heartbeat.

-

- Second-Degree AV Blockage:

-

- Will typically begin to show an irregular heartbeat pattern.

-

- Third-Degree AV Blockage:

-

- These are considered complete heart blockages whereby there are no atrial impulses sent to the ventricle.

-

Now…

Before we get too ahead of ourselves and before anyone really starts critiquing our description of what an atrioventricular blockage is and how it is defined, please understand this one thing…

“We here at IBUSA are not medical professionals, and we’re certainly not doctors!”

All we are is a bunch of life insurance agents who just happen to be really good at helping folks with a wide variety of pre-existing medical conditions find and qualify for the life insurance policies that they’re looking for.

Which is why…

We don’t really need to fully understand all of the nitty-gritty details when it comes to how atrioventricular blockages work, we just need to understand that it is a condition

- That affects the normal electrical transmissions within the heart,

- Individuals diagnosed with this condition will be classified into one of three different categories,

And what questions the insurance underwriters will want answered prior to making their decision about the outcome of your life insurance application. This brings us to our next topic…

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were you first diagnosed with an atrioventricular blockage?

- Who diagnosed your AV block? A general practitioner or a cardiologist?

- What symptoms (if any) led to your diagnosis?

- Heart palpitations?

- Chest pain?

- Fatigue?

- Dizziness or lightheadedness?

- Shortness of breath?

- ; etc.…

- What “degree” have you been diagnosed with?

- First degree?

- Second degree?

- Third-degree or Complete Heart Block?

- What treatment options have you pursued?

- Medications?

- Surgical procedures? Pacemakers?

- How have these treatment options worked?

- Do you currently suffer from any symptoms related to your AV blockage?

- Have you been diagnosed with any other cardiovascular medical conditions?

- Have you suffered from a previous heart attack or stroke?

- In the past two years, have you been hospitalized for any reason?

- What is your current height and weight?

- Are you currently working now?

- In the past 12 months, have you applied for or received any kind of disability benefits?

What rate (or price) can I qualify for?

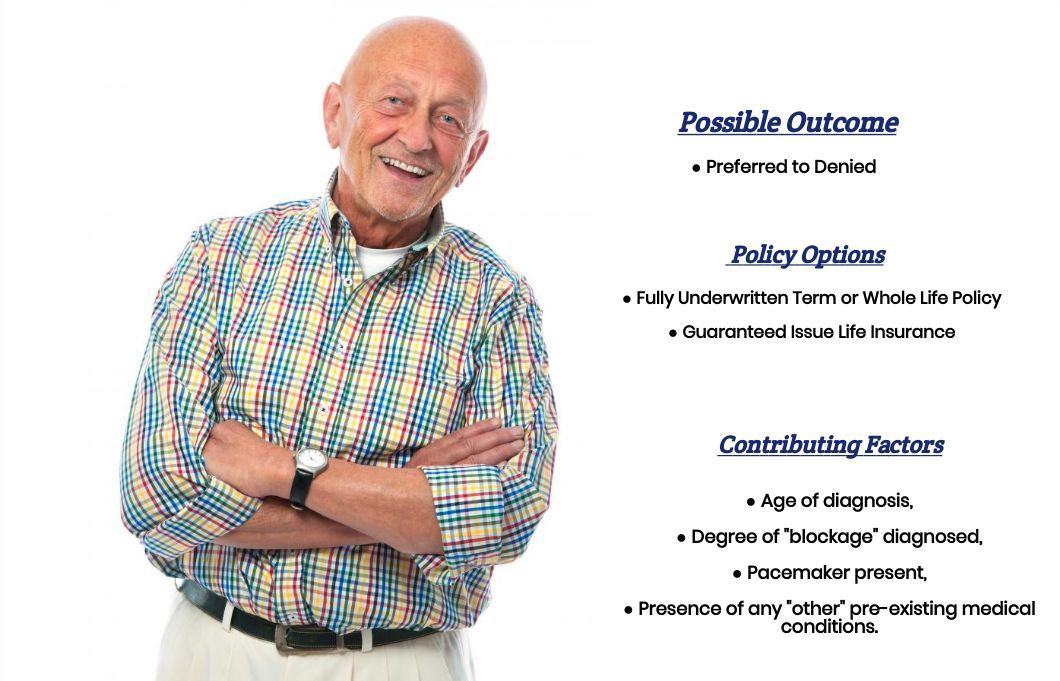

As you can see, there are a lot of factors that can come into play when determining what the outcome of an individual’s life insurance application will be. This is why it’s pretty much impossible to know for sure what kind of “rate” you might be able to qualify for without speaking with you directly. That said, however, there are some “assumptions” that we can make that will generally hold true so that you can get a general “idea” about what kind of rate you might be able to qualify for.

For example…

What we’ll usually find is that those who have been diagnosed with an incomplete or 1st degree atrioventricular blockage absent any symptoms of their disease can and often will be able to qualify for a Preferred rate, assuming that they would otherwise be able to qualify for such a rate.

Second-degree atrioventricular blockage applicants…

Who have already had a pacemaker implanted for over six months and are able to demonstrate that they no longer suffer from any significant lingering effects of their disease and seem to be responding well to their treatment may also be able to qualify for a traditional term or whole life insurance policy only now they will generally only be able to qualify for a “substandard” or “high risk” category.

As for those suffering from second-degree atrioventricular blockage absent a pacemaker, you will find that they too may be able to qualify for coverage only they will usually find themselves being considered a “higher” risk for coverage and will subsequently have to pay more for their life insurance.

The same will hold true…

For those who have been diagnosed with a 3rd Degree of atrioventricular blockage or Complete Heart Block only in cases like these, only those who have already received a pacemaker will be considered “potentially” eligible, with all other cases being postponed until which time an individual does receive a pacemaker to correct their condition.

The good news is…

That while all of this may seem really confusing to sort out, should you decide to give us a call here at IBUSA, you won’t have to do it on your own! This is why we wanted to take a moment and conclude this article by just reviewing a couple of things that you can do yourself to help increase your chances of finding the “best” life insurance policy that you can qualify for.

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to find the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

And seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is exactly what you’re going to find here at IBUSA.

Now, will we be able to help out everyone who has been previously diagnosed with an AV blockage?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Top Rated Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, just give us a call!