One thing that is often overlooked when applying for a traditional term or whole life insurance policy is that, in addition to meeting medical requirements, you may also need to meet certain financial qualifications. This is particularly true when applying for a large amount of coverage.

Therefore, it’s important to understand the financial aspect of life insurance and how it affects your ability to obtain coverage. For this reason, we wanted to take a moment and discuss what factors may come into play when determining…

“How much insurance you can get?”

Questions that will be addressed in this article will include:

- How do life insurance companies determine how much insurance a person can purchase?

- Why do life insurance companies “limit” how much coverage a person can purchase on themselves?

- What’s the best way to determine how much life insurance I need?

- What can I do to ensure that I buy the “right” life insurance policy for me?

So, without further ado, let’s dive right in!

How do life insurance companies determine how much insurance a person can purchase?

To understand how much life insurance an individual can purchase, it is important to first understand the purpose of insurance. The primary goal of any insurance is to indemnify or compensate for loss or damage. This is often described as “making one whole.”

Life insurance, specifically, is designed to help a family compensate for the financial loss they would suffer if the insured were to die prematurely. Essentially, it is about replacing the future income that the insured would have earned had they lived. While it may seem cold or clinical, the insurance industry is all about statistics, dollars, and cents. This is why most life insurance companies use a strict set of rules to determine how much coverage a person can qualify for.

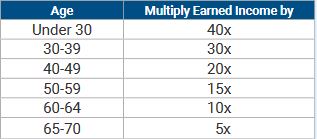

Each insurer may have their own guidelines, but they typically consider factors such as age, health, lifestyle, occupation, and existing coverage when determining coverage amounts. Most companies use a formula that involves multiplying the individual’s current active income by a certain number of years based on their age.

The “number of years” will be dictated by one’s current age and will usually look something like this:

We should not that when an insurance company assesses a person’s income to determine the amount of coverage they can qualify for, they typically only consider the individual’s “active” income or income that would be lost if the insured were to die.

This means that if someone is not currently working or is retired and has only passive income, they may find it challenging to justify the amount of insurance they are requesting. In such cases, it is crucial to work with a knowledgeable insurance professional who can help structure the application in a way that maximizes the chances of success.

It is also important to note that certain types of life insurance policies, such as no medical exam term life insurance or guaranteed issue final expense insurance, may have additional limitations on the amount of coverage that can be purchased.

At this point, one may wonder why insurance companies limit the amount of coverage a person can purchase, even if they can afford it. The reason for this is that insurance companies use actuarial science to assess risk and determine premium rates. The higher the coverage amount, the higher the risk for the insurer. Therefore, to minimize their risk and ensure their financial stability, insurers limit the amount of coverage a person can purchase based on various factors, including age, health, lifestyle, and occupation.

Why do life insurance companies “limit” how much coverage a person can purchase on themselves?

Life insurance companies limit the amount of life insurance an individual can purchase because the purpose of a life insurance policy is to financially indemnify the beneficiary in the event of the insured’s premature death. The goal is not to enrich the beneficiaries but to ensure they are not financially devastated by the loss of the insured. Moreover, a life insurance company never wants to find itself insuring someone whose death would be more valuable to their family than their life.

However, it’s important to note that just because a person qualifies for a million or ten million dollar life insurance policy, it doesn’t mean they should purchase that amount. The key is determining the appropriate coverage needed to protect loved ones.

To determine the right amount of life insurance, several factors need to be considered. These may include but are not limited to age, income, family size, debts, and financial goals. By taking these factors into account, an individual can make an informed decision about how much life insurance they need to adequately protect their loved ones.

What’s the best way to determine how much life insurance I need?

For starters, you can use our life insurance calculator to give you an idea of how much life insurance you need.

LIFE INSURANCE CALCULATOR

Adjust the sliders to fit your criteria. View your results below.

RESULTS

Your total cost for years of retirement at per year is:

Assuming you retire at age , you have investing years left. Using a annual rate of return for your investments, you're expected to earn a total of .

Determining the right amount of life insurance to protect loved ones adequately is not an exact science. However, one useful approach is to use the “Rule of Seven,” which suggests that a financially dependent beneficiary should receive a minimum of seven times the insured’s annual income in life insurance coverage.

For instance, a 58-year-old man earning $85,000 a year with two college-aged children might consider purchasing $600,000 in life insurance coverage. However, this rule may not apply to everyone, as the needs of each family can vary greatly.

For a 34-year-old with two young children and an income of $65,000, the “Rule of Seven” would suggest coverage of $450,000 to $500,000, which may not be enough to meet the family’s long-term financial needs.

That’s why life insurance companies often offer policies of up to 25 times the insured’s annual income for individuals in their early 30s. It’s essential to consider individual circumstances, such as mortgage payments and college tuition expenses, when determining the right amount of coverage.

At IBUSA, we recommend combining the “Rule of Seven” with an individual’s monthly budget to determine a comfortable premium payment. It’s crucial to feel comfortable with the payment to maintain the policy in force to ensure that the family is adequately protected in the event of the insured’s premature death.

This brings us to the last topic that we wanted to discuss here in this article which is…

What can I do to ensure that I buy the “right” life insurance policy for me?

There are several steps you can take to ensure you buy the “right” life insurance policy for your needs:

- Evaluate your financial situation: Determine your current and future financial obligations, including debts, mortgage payments, and college tuition for children.

- Assess your life insurance needs: Consider who you want to provide for and for how long. For example, do you want to provide for your spouse’s retirement, your children’s education, or pay off your mortgage?

- Determine the type of life insurance policy you need: There are two main types of life insurance policies: term life and permanent life insurance. Term life insurance provides coverage for a specific period, usually 10 to 30 years, while permanent life insurance provides lifetime coverage. Consider which type of policy best meets your needs.

- Determine the coverage amount: Use the “Rule of Seven” as a starting point, but adjust the amount based on your individual circumstances.

- Compare policies and quotes from different insurance companies: Take time to research and compare policies and quotes from various insurance companies to find the best coverage and premium rates.

- Work with a licensed insurance agent: A licensed insurance agent can help you navigate the complex process of buying life insurance and help you find the best policy to meet your needs.

- Review and update your policy regularly: As your life circumstances change, such as getting married or having children, it’s essential to review and update your life insurance policy to ensure it still meets your needs.

Frequently asked questions

How do life insurance companies determine how much coverage I qualify for?

Life insurance companies use several factors to determine how much coverage you qualify for. The primary factors include your age, health, gender, occupation, income, and lifestyle habits (such as smoking or drinking).

Insurance companies will also look at your medical history, including any pre-existing conditions, medications you are taking, and any previous surgeries or hospitalizations. They may also require you to undergo a medical exam, which typically includes a blood test, urine test, and physical exam, to determine your health status.

Additionally, insurers will consider your personal circumstances, such as your marital status, number of dependents, and financial obligations. All of these factors are used to assess your risk profile and determine how much coverage you qualify for.

Is there a limit to how much life insurance coverage I can qualify for?

Yes, there is usually a limit to how much life insurance coverage you can qualify for, and it varies by insurance company. The limit is typically based on your income and overall financial situation.

Can I qualify for more than one life insurance policy?

Yes, you can qualify for more than one life insurance policy. In fact, it’s common for people to have multiple policies to provide extra coverage or to meet different financial needs.

However, keep in mind that insurance companies typically have limits on the total amount of coverage you can have across all of your policies. This is called the “total coverage limit” or “coverage cap.” The coverage cap varies by insurance company and is based on your age, health, occupation, income, and other factors.

For example, if the coverage cap is $10 million and you already have a $5 million policy, you may only be able to qualify for an additional $5 million in coverage from another insurer.

Having multiple life insurance policies can offer additional protection and flexibility, but it’s important to evaluate your financial obligations and determine how much coverage you need before applying for multiple policies. Additionally, be sure to disclose all of your existing policies to the insurer when applying for a new policy, as failure to do so could result in the cancellation of your policies.

Can I increase my coverage amount over time?

Yes, you can typically increase your coverage amount over time by adding to your existing policy or purchasing additional policies. However, you will need to qualify for the additional coverage based on the insurance company’s underwriting guidelines.

How much life insurance coverage do I really need?

The amount of life insurance coverage you need will depend on several factors, including your financial obligations, assets, and goals. Here are some factors to consider when determining how much life insurance coverage you need:

- Income replacement: Consider how much income your loved ones would need if you were no longer there to provide for them. A general rule of thumb is to have coverage that equals 10-12 times your annual income.

- Debt and expenses: Take into account your outstanding debts, such as a mortgage, car loans, or credit card debt. You’ll also want to consider other expenses, such as funeral costs, medical bills, and your children’s education.

- Assets: Consider your savings, retirement accounts, and other assets you have that could be used to provide for your loved ones.

- Future goals: Think about future expenses, such as college tuition or retirement savings, that you want to provide for.

- Current insurance coverage: Take into account any existing life insurance policies you have.

Once you have a sense of these factors, you can use an online life insurance calculator or work with a financial professional to help determine how much coverage you need. It’s important to periodically review and adjust your coverage as your financial situation changes.

Can I be denied coverage for life insurance?

Yes, you can be denied coverage for life insurance based on several factors, including your health, age, and lifestyle habits. If you are denied coverage, you can typically appeal the decision or explore other insurance options, such as a guaranteed issue life insurance policy.