It’s close to impossible to discuss purchasing a final expense life insurance policy without mentioning Globe Life Insurance. The company has chosen to specialize in offering small-term and whole-life insurance policies that can be an excellent solution for those seeking coverage for any final expenses that may occur upon their passing.

However, it’s important to note that Globe Life Insurance Company offers several different insurance options for its clients. Although each option may be suitable for some individuals, the variety can often become overwhelming, especially for those who are primarily concerned with the cost of their insurance.

That’s why we’d like to take a moment to provide some background information on Globe Life Insurance and highlight some of the pros and cons of its most popular policies. By doing so, you can better determine if Globe Life Insurance is the right choice for you, and you’ll have a better idea of how it compares to other insurance providers.

Compare over 50 top life insurance companies instantly.

|

About Globe Life

Globe Life and Accident Insurance Company, a Texas-based insurer, has been providing relatively low-coverage life insurance for almost 70 years. While Globe Life initially marketed its products in rural communities in Texas and Oklahoma, it now offers life insurance policies in every state except New York. With an A+ rating from AM Best, Globe Life is considered a financially strong life insurance company.

Globe Life’s marketing efforts emphasize its “$1 per month life insurance” and 30-day money-back guarantee. However, the $1 rate only applies to the first month, and premiums are calculated based on age, gender, and coverage amount thereafter. The 30-day guarantee allows purchasers to cancel their coverage for a full premium refund within thirty days of policy issuance, although in some states, insurers are required to offer this feature regardless.

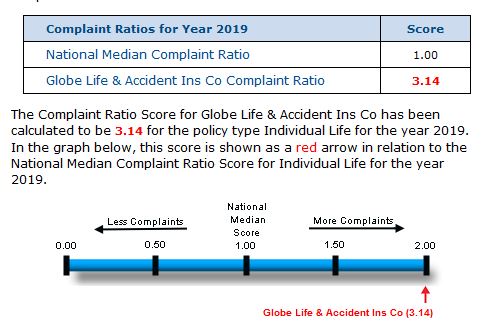

Globe Life forgoes agents and sells policies directly to consumers, which could potentially result in lower rates. However, this approach can also make customer interactions with the company more burdensome. Consumer satisfaction ratings for Globe Life are difficult to come by compared to most insurance companies. According to the National Association of Insurance Commissioners, Globe Life draws substantially more consumer complaints to state insurance commissioners than most life insurance carriers, adjusted for the company’s size and share of the life insurance market.

While Globe Life Insurance might be a suitable option for some people looking for final expense life insurance, it’s important to shop around and compare policies from multiple insurers. By doing so, individuals can get a better understanding of the pros and cons of each policy and ultimately make an informed decision that is best for their specific needs.

Globe Life’s Final Expense Insurance Products

Globe Life offers three principal life insurance products: Globe Life Term Life Insurance for Adults, Globe Life Whole Life Insurance, and Globe Life Whole Life Insurance for Children.

The first two are both marketed as final expense life insurance; however, only the whole life policy is guaranteed to remain in place for life.

Both policies for adults have relatively low available coverage levels, making Globe Life coverage a potential option for final expense insurance but not well-suited to income replacement.

Globe Life’s whole-life coverage for children allows parents or grandparents to lock in permanent coverage for a minor at very low rates.

A policy can become a future source of final expense coverage for the covered child but is not useful as final expense coverage for the purchaser.

Globe Life’s Application Process:

All three of Globe Life’s life insurance offerings are no exam life insurance, which means that the application process does not require a formal medical exam.

However, the application process does require a medical questionnaire, and the company pulls prescription history and Medical Information Bureau reports on applicants.

Among other things, Globe Life’s application for life insurance asks whether adult applicants use a wheelchair, are under nursing home care, or have been diagnosed with cancer, brain, heart, kidney, or liver problems, lung disease, mental or nervous disorders, or HIV/AIDS.

If an applicant has any other conditions for which Globe Life screens—or if the prescription history or Medical Information Bureau reports turn up any information Globe Life is uncomfortable with—an application for coverage will be denied.

The application for Whole Life Insurance for Children is considerably less detailed, asking only if the child has any chronic illnesses or conditions or has been diagnosed with HIV/AIDS.

Globe Life does not offer a guaranteed acceptance life insurance policy that won’t consider an applicant’s medical history in the underwriting process. Because Globe Life does not offer any guaranteed acceptance products, it also doesn’t require a waiting period before full coverage kicks in.

Globe Life Policy Availability, Premiums, and Coverage Limits.

Let’s take a look at Globe Life’s four different insurance products.

Globe Life Term Life Insurance for Adults:

Globe Life’s best-selling and most heavily marketed product is its term policy. The policy is available to applicants between 18 and 79 years old in coverage amounts between $5,000 and $100,000.

Term life insurance policies can be renewed in five-year increments, and the premium payments will increase upon each renewal.

However, the policy lapses at age 90, at which point renewal is no longer possible for any premium.

If you’re buying life insurance to provide income security to your loved ones in the event you die during your working years—and you’re not worried about losing the coverage when you reach retirement age—term life can be a good option.

But, if you want to make sure your loved ones or estate have enough liquidity to pay for funeral and burial expenses, taxes, administrative costs, and any estate debts, you’re probably better off with a permanent policy guaranteed to stay in place at the same premium rates for life.

Consumers looking for term coverage for income replacement over a long period are usually better off with policies that offer an extended term with fixed premiums.

The rates for a long-term policy are usually higher in the beginning, but over the course of, for instance, a twenty-year term, the total premiums paid will almost always be less than compared to a policy that requires renewal (and a rate increase) every five years.

Term coverage—whether with an extended term or shorter renewable terms—generally isn’t a good option for individuals who want to purchase life insurance to pay for funeral and burial costs and other final expenses.

By definition, a term policy eventually expires, which means that unless you die before the end of the term, no death benefit will be available.

Premiums Increase

Life insurance premiums for term coverage increase dramatically as the insured ages.

For many seniors on fixed incomes, term premiums increase to the point that the policy might as well have lapsed because they have become essentially unaffordable.

Globe Life will let you renew until age 90, but the premiums will be much, much higher as you age, and if you live past 90, you will no longer have life insurance.

For younger applicants, the premiums for renewable term coverage look low at first, but over a long coverage period and factoring in rate increases, the value diminishes.

For instance, a male insured who applied for $20,000 in term coverage at age 41 and kept the policy in place through his 80th birthday would have paid premiums totaling over $10,000 more than the policy limits.

And at age 81, the rates will again increase dramatically.

If the policy isn’t triggered, all those premiums are lost.

Conversely, most whole-life policies have fixed premiums and accrue cash value so that, over time, the surrender value of the policy exceeds the total premiums paid in.

And, of course, permanent coverage won’t lapse as long as the premiums are paid.

Globe Life Whole Life Insurance:

The whole life insurance policy for adults from Globe Life is available to applicants from age 18 through 79 in coverage amounts of $5,000, $10,000, $20,000, $30,000, or $50,000.

As a permanent, whole-life policy, Globe’s senior life insurance features fixed premiums for the life of the policy and accrues cash value.

Although existing medical issues can result in denial or higher premiums, an insured who later develops a medical condition that would have been disqualifying or led to higher premiums will not have his or her premiums increased after the policy is issued.

Globe Life’s whole-life coverage is designed more as final expense insurance intended to remain in place for life than as a combined insurance and investment product doubling as a source of retirement savings.

Policyholders can borrow money against a whole life policy’s cash value, with loans extended by the company at a fairly reasonable rate.

If a loan remains outstanding at the time of the insured’s death, the loan balance will be deducted from the death benefit.

While Globe Life’s whole-life policy is well-suited to cover funeral and burial costs and other final expenses, there are other insurers who offer similar products at more attractive rates.

Globe Life Whole Life Insurance for Children:

The whole life product offered by Globe Life for children is available for new applicants from birth to age 24. Available policy limits range from $5,000 to $30,000.

Although Globe Life Whole Life for Children is not a source of final expense coverage for a policy purchaser, it can be an excellent means of obtaining well-priced permanent coverage with cash value that lasts for the entire life of a child.

Globe Life’s policies for children are simplified issues. They require a health questionnaire but not a medical exam and do not include a waiting period.

As whole life insurance, the policies have fixed premiums, accrue cash value, and will never lapse.

Upon reaching adulthood, the insured former child can take over the policy and retain permanent life insurance coverage at rates much lower than policies offered to adults.

Alternatively, the insured can elect to surrender the policy for its cash value. The cash value of whole life insurance earns interest over time, so a policy that remains in place during an insured’s entire childhood can become a good source of funds to pay for higher education.

Globe Life Accidental Benefits Insurance:

Globe Life also offers a more specialized accidental death and dismemberment (AD&D) policy, providing coverage up to $250,000 for applicants between the ages of 18 and 69.

The coverage area is fairly narrow—benefits only pay out if the insured’s death results from a bona fide accident.

Death resulting from illness, for instance, is not covered.

Unlike Globe Life’s life insurance offerings, the AD&D policies are guaranteed issue, which means they do not require any health screening or medical exam. This makes sense because the insurer is not worried about an insured dying early from an illness, as deaths due to illness are not covered.

Premium rates are fixed for the life of the policy, and all policies include inflation-adjustment provisions and partial coverage for dismemberment or paralysis.

If death results from an injury incurred as a passenger on a commercial airline, the policy’s principal benefit is doubled.

Globe Life’s Accidental Benefits policy has an available “Family Plan” that, for an additional premium, extends coverage to the principal insured’s spouse and children.

The benefit for the spouse is measured as half of the insured’s benefit, and children’s coverage pays out at 10% of the policy’s face value.

Final thoughts…

While Globe Life Insurance Company may have some attractive features, such as its low-cost policies and financial strength rating, it’s important to keep in mind that they may not be the right fit for everyone. Every individual’s insurance needs are unique, and it’s crucial to shop around and compare quotes from multiple insurance companies before making a decision.

By doing so, you can ensure that you’re getting the best coverage for your specific needs and budget. Additionally, it’s important to consider factors beyond just the cost, such as the company’s customer service reputation, claims handling process, and coverage options.

Ultimately, while Globe Life Insurance may be a good option for some individuals, it’s important to take the time to research and compare multiple insurance companies before making a decision. This can help ensure that you find the right life insurance policy to meet your specific needs and provide you and your loved ones with the peace of mind that comes with having adequate coverage.