In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Adderall XR to treat their Attention Deficit/Hyperactivity Disorder (ADHD).

Questions that will addressed will include the following:

- Can I qualify for life insurance after I’ve been prescribed Adderall XR?

- Why do life insurance companies care if I’ve been prescribed Adderall XR?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Adderall XR?

Yes, it is possible to qualify for life insurance after being prescribed Adderall XR. Still, your medication use may affect the specific terms of the coverage and the premiums you will be offered. So, if you have been prescribed Adderall XR for a medical condition, it is important to disclose this information to the life insurance company. The company may ask for additional information about your diagnosis, treatment, and prognosis and may require a medical examination as part of the underwriting process.

Now…

The impact of Adderall XR on your life insurance coverage will depend on the specific details of your case. Some factors that may be considered include the severity of your condition, the length of time you have been taking the medication, and the effectiveness of the treatment. In some cases, life insurance companies may offer higher premiums or exclude coverage for certain conditions. In contrast, in other cases, they may provide standard coverage at standard premiums or deny coverage entirely.

Why do life insurance companies care if I’ve been prescribed Adderall XR?

Most of the top-rated Life insurance companies aren’t all that worried about Adderall XR per se because Adderall XR doesn’t have any severe side effects that could be harmful or life-threatening.

Instead…

What concerns your average life insurance company is that Adderall XR is a medication that is used to treat ADHD. While most would argue that suffering from ADHD isn’t quite as serious as cancer or heart disease, it remains one of those “types” of pre-existing medical conditions that could prevent someone from qualifying for a traditional term or whole life insurance policy. Especially when you take a look at some of the most common symptoms associated with ADHD, such as:

- Mood swings include aggression, excitability, hyperactivity, and impulsivity.

- Lack of restraint.

- Absent-mindedness, difficulty focusing, forgetfulness.

- And depression.

Now, will everyone suffering from ADHD suffer from these “types” of symptoms?

No, of course not. But until an insurance underwriter understands how severe your ADHD is, you’ll generally find that most, if not all, life insurance companies are going to be extremely nervous about approving your life insurance application.

So, what kind of information will the insurance companies ask me or be interested in?

If you are applying for life insurance and have been prescribed Adderall XR, the insurance company may ask for additional information about your diagnosis, treatment, and prognosis. This may include information about your symptoms, how they have been affected by the medication, and any side effects you have experienced. The insurance company may also ask about your medical history, including any other conditions you have or have had and any medications you are currently taking or have taken in the past.

In addition to…

These medical questions, the insurance company may also ask about your age, lifestyle, and occupation, as these factors can affect your overall health and risk level. They may also require you to undergo a medical examination as part of the underwriting process, including a physical exam, blood and urine tests, and possibly other diagnostic tests.

Specific questions relating to your Adderall XR prescription may include:

- When were you first diagnosed with ADHD?

- When were you first prescribed Adderall XR?

- Who prescribed your Adderall XR? Your primary care physician or a psychiatrist?

- How long have you been taking your Adderall XR?

- Over the past 12 months, has your prescription changed at all?

- Are you taking any other prescription medications to treat your ADHD?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any issues with your driving record? Issues such as multiple moving violations, DUI, or a suspended license?

- Do you have any history of drug or alcohol abuse?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate class can I qualify for?

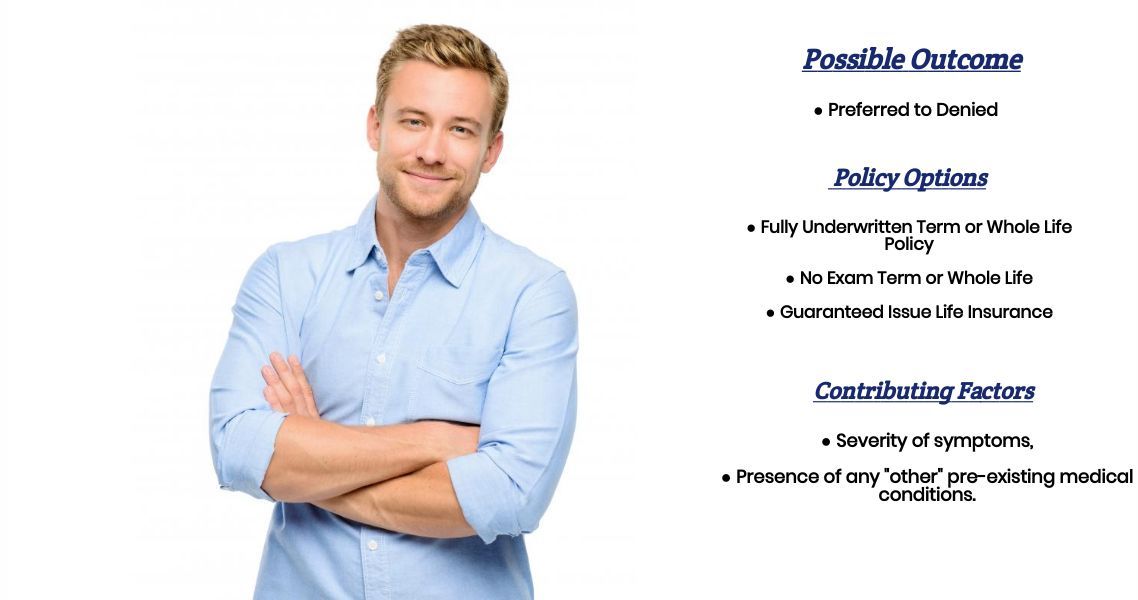

As a general rule of thumb, assuming that your ADHD is well under control and you have a steady work history, you’re typically going to find that there are a few life insurance companies willing to ensure “ADHD applicants” at a Preferred rate. What this means is that assuming that you are in otherwise good condition, having been prescribed Adderall XR to treat your ADHD should in and of itself not have any effect on the outcome of your life insurance application.

Now that being said…

Suppose you have struggled with your condition or have other pre-existing medical conditions that could potentially “complicate” your life insurance application. In that case, you may find that these “other” conditions might become the center of attention during your application process. This brings us to our next topic, which is…

How can I help ensure I get the “best life insurance” for me?

The most important thing an individual can do to increase their chances of buying the best life insurance policy they can qualify for is to “shop” their options.

You see…

When deciding who an insurance company will and won’t insure, each company is free to make up its own rules/guidelines. As a result, you’re going to find that certain companies can “tend” to be more lenient regarding certain pre-existing medical conditions or lifestyle choices.

This is why, it’s important to choose an insurance agency that has access to dozens of different life insurance companies so that in addition to just seeking out which company “might” be the “best” for you if you’ve been prescribed Adderall, they can also look for the “best life insurance” for you if you’ve been prescribed Adderall. You’re a little bit overweight too!

Now, will we be able to help out everyone who has been prescribed Adderall?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies.

So that…

If someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for. So, if you’re ready to see what options might be available, call us!