In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance with Proteinuria.

Questions that will be addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Proteinuria?

- Why do life insurance companies care if I’ve been diagnosed with Proteinuria?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance if I’ve been diagnosed with Proteinuria?

Yes, individuals who have been diagnosed with Proteinuria can and often will be able to qualify for a traditional term or whole life insurance policy.

The only problem is…

That simply knowing that you have been diagnosed with Proteinuria isn’t going to be enough information for most life insurance companies to make their decision about your application.

This is why…

Prior to being approved for a traditional life insurance policy, one should expect to have to answer a series of medical questions about your Proteinuria which will all be designed to learn more about “why” you have been diagnosed with Proteinuria and whether or not your Proteinuria might be a symptom of some other more serious pre-existing medical condition.

Why do life insurance companies care if I’ve been diagnosed with Proteinuria?

Life insurance companies care about an individual’s medical history, including any diagnoses of proteinuria, because it can be (but isn’t always) an indication of underlying health problems or conditions that may increase the risk of premature death. Proteinuria, or the presence of protein in the urine, can be a sign of kidney disease or damage, which can be a serious and potentially life-threatening condition.

This is why…

We wanted to take a moment and discuss what Proteinuria is as well as highlight some of the most common symptoms/complications that can occur with this illness so that we might gain a better understanding of what a life insurance underwriter will be looking for when making his or her decision about your life insurance application.

Proteinuria Defined:

Proteinuria is a medical condition in which there is an abnormal amount of protein in the urine. It can be a sign of kidney damage or other underlying health conditions. Proteinuria can be detected through a urine test and is often accompanied by other signs and symptoms, such as swelling in the extremities, high blood pressure, and foamy or bubbly urine. Treatment for proteinuria may involve lifestyle changes, medication, or further medical evaluation and treatment for the underlying cause. It is important to seek medical attention if you have persistent proteinuria, as it can be a sign of a serious health problem.

Potential causes of Proteinuria:

There are many potential causes of proteinuria, including:

- Kidney damage: Proteinuria can be a sign of damage to the kidneys, which are responsible for filtering waste products and excess fluids from the body. Damage to the kidneys can be caused by a variety of factors, such as high blood pressure, diabetes, and inflammation.

- Infection: Infections, such as urinary tract infections or sexually transmitted infections, can cause proteinuria.

- Medications: Some medications, such as nonsteroidal anti-inflammatory drugs (NSAIDs) and some blood pressure medications, can cause proteinuria as a side effect.

- Physical stress: Intense physical activity or dehydration can cause proteinuria, especially in people who are not used to exercising regularly.

- Pregnancy: Proteinuria is common during pregnancy and is usually not a cause for concern.

- Other underlying conditions: Proteinuria can also be a sign of other underlying health conditions, such as lupus or multiple myeloma.

Symptoms of Proteinuria may include:

- The main symptom of proteinuria is the presence of protein in the urine, which can be detected through a urine test. However, proteinuria may also cause other signs and symptoms, such as:

- Swelling: Proteinuria can cause fluid to build up in the body, leading to swelling in the hands, feet, and face.

- High blood pressure: Protein in the urine can be a sign of high blood pressure, which can cause a variety of symptoms such as headache, dizziness, and shortness of breath.

- Foamy or bubbly urine: Proteinuria can cause the urine to appear foamy or bubbly, due to the presence of excess protein.

- Other symptoms: Depending on the underlying cause of proteinuria, other symptoms may also be present, such as fever, pain while urinating, or general feelings of unwellness.

Treatment of proteinuria:

For those suffering from “mild” or “temporary” Proteinuria, its possible that no treatment may be necessary. As for those suffering from more “serious” cases of Proteinuria or are suffering from Proteinuria as a direct result of some other “kind” of pre-existing medical condition, treatment for this “underlying” cause may be required.

Treament in such situations may include:

- Lifestyle changes: If proteinuria is caused by high blood pressure, diabetes, or other underlying health conditions, lifestyle changes may be recommended to help manage these conditions and reduce proteinuria. These changes may include eating a healthy diet, getting regular exercise, quitting smoking, and managing stress.

- Medications: Depending on the cause of proteinuria, medications may be prescribed to help manage the condition. For example, blood pressure medications may be prescribed to lower blood pressure, and medications called ACE inhibitors or ARBs may be prescribed to help reduce proteinuria.

- Further medical evaluation: If the cause of proteinuria is unclear or if the condition does not improve with lifestyle changes or medication, further medical evaluation may be necessary. This may include additional tests and procedures to determine the underlying cause of the proteinuria and appropriate treatment.

What kind of information will the insurance companies ask me or be interested in?

If you have been diagnosed with proteinuria, life insurance companies may ask for information related to your medical history, such as:

- The date of your diagnosis

- The underlying cause of your proteinuria (e.g. diabetes, hypertension, kidney disease)

- The severity of your proteinuria, including the amount of protein detected in your urine

- The treatments you have received for proteinuria, such as medication or lifestyle changes

- Any complications or other health problems that have resulted from your proteinuria

- The results of any recent medical tests or examinations related to your proteinuria, such as kidney function tests or blood pressure measurements.

Insurance companies may also request access to your medical records in order to obtain a more comprehensive understanding of your medical history and any treatment you have received for your condition.

Keep in mind that the specific information requested by an insurance company may vary depending on the company’s policies and the type of life insurance policy you are applying for. It’s always best to be truthful and provide as much information as possible to ensure an accurate assessment of your risk and to avoid any issues with your policy in the future.

What rate (or price) can I qualify for?

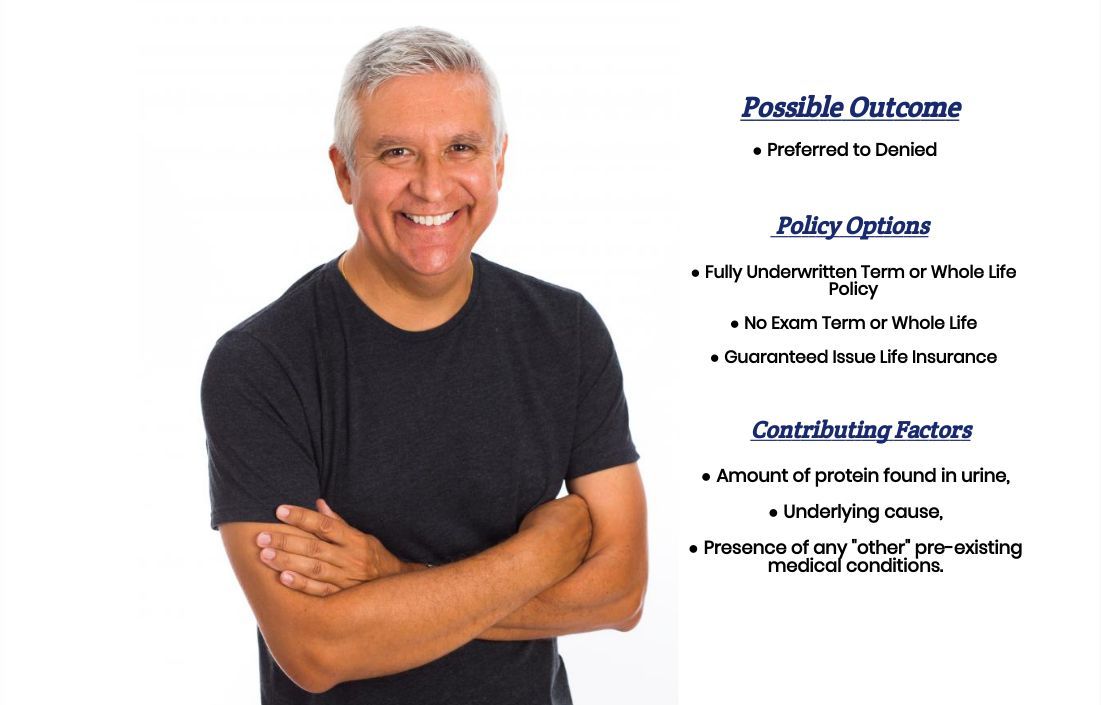

As you can see, there are many variables that can come into play when trying to determine what kind of “rate” an individual diagnosed with Proteinuria. This is why it’s almost impossible to know what kind of “rate” you might qualify for without first speaking with you directly.

That said, however…

Most individuals who have been diagnosed with Proteinuria will usually fall into one of three different categories that we can make some “assumptions” about that will generally hold true.

Category #1.

The first group that we’ll possibly encounter will be those suffering from either a very mild case of Proteinuria or a case that is caused by some kind of “temporary” condition. In situations like these, an individual may be able to qualify for a traditional life insurance policy, and given the right advice combined with some fortunate timing, they may even be able to qualify for a Preferred rate!

Category #2.

Individuals who fall into this category will suffer from a “moderate” case of Proteinuria, absent any “serious” pre-existing medical conditions like uncontrolled Diabetes or previous kidney damage.

In cases like these, an individual still might be able to qualify for a traditional life insurance policy only now it’s pretty safe to say that they’re generally going to be considered a “higher risk” applicant which means that they probably won’t be able to qualify for anything better than a Standard rate (if they’re lucky).

Category #3.

The last group that we’ll commonly encounter will be those who have been diagnosed with a severe case of Proteinuria combined with someone other “serious” pre-existing medical condition.

In cases like these, what you’re generally going to find is that most life insurance companies (if not all) are going to deny you’re application which means that you’ll need to seek out an “alternative” product like a Guaranteed Issue Life Insurance Policy, if you still wish to seek out some coverage.

The good news is…

That regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with all sorts of pre-existing medical conditions like yours and are committed to helping all of our clients find the “best” life insurance policy that they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

What can I do to help ensure that I get the “best life insurance” for me?

If you have been diagnosed with proteinuria, there are a few things you can do to help ensure that you get the best life insurance coverage for you:

- Work with a licensed and experienced insurance agent: An agent can help you navigate the application process and find the best policy for your needs. They can also help you understand the underwriting process and work with the insurance company to get you the most favorable coverage.

- Provide complete and accurate medical information: It is important to be honest and transparent about your medical history, including your proteinuria diagnosis. This will help ensure that the insurance company has an accurate understanding of your health and can provide you with the most appropriate coverage.

- Keep your health in check: If you have proteinuria, it is important to work with your doctor to manage your condition and keep it under control. By doing so, you can show the insurance company that you are taking steps to maintain your health and reduce your risk of developing other health problems.

- Shop around: Different insurance companies have different underwriting guidelines, so it may be beneficial to shop around and compare policies from multiple providers. This can help you find the best coverage and rates for your specific situation.

- Consider a guaranteed issue policy: If you have been denied coverage or are unable to qualify for traditional life insurance due to your proteinuria diagnosis, you may want to consider a guaranteed issue policy. These policies do not require a medical exam or underwriting, but they may have higher premiums and lower coverage limits than traditional policies.

Remember, getting the best life insurance coverage after a proteinuria diagnosis may require some extra effort and research, but it is possible to find coverage that meets your needs and fits within your budget.