In this article, we would like to address some of the most frequently asked questions we receive from individuals who are applying for life insurance after being diagnosed with anemia.

We will cover the following questions:

- Can I qualify for life insurance if I have been diagnosed with anemia?

- Why do life insurance companies consider anemia in their underwriting process?

- What type of information will insurance companies request from me, and what are they interested in?

- What life insurance rates or prices can I qualify for?

- What can I do to ensure that I obtain the best possible life insurance policy for my needs?

Without further delay, let’s get started!

Can I qualify for life insurance if I have been diagnosed with Anemia?

Yes, individuals who have been diagnosed with anemia can often qualify for a traditional term or whole life insurance policy. In fact, they may even qualify for a preferred plus rate on a no-exam life insurance policy, provided that the condition has resolved itself.

However, there are several reasons why someone might become anemic, and not all of them will cause concern for a life insurance underwriter. On the other hand, some factors may significantly affect your eligibility for a traditional term or whole life insurance policy.

Why do life insurance companies care if I have been diagnosed with Anemia?

To understand why a life insurance company is likely to “care” if an individual has been diagnosed with Anemia, it’s probably better to think of Anemia as a “symptom” of some other “kind” of pre-existing condition rather than the actual “condition” itself. After all, this is usually how a life insurance underwriter will view being “anemic”.

And this is…

Where we can begin to run into trouble because there are literally over 400 different “reasons” why an individual might become anemic. Fortunately, most of these potential reasons why an individual might become anemic can usually be grouped into one of three categories.

Those that are…

- Caused by blood loss,

- Caused by decreased production or faulty production of red blood cells,

Or those cause by the destruction of red blood cells.

Now depending on…

Why you have become anemic can and often will have a significant role in the outcome of your life insurance application which is why before being approved for a traditional term or whole life insurance policy, you can bet that most (if not all) of the top life insurance insurance companies are going to what to ask you a series of medical questions about “why” you have become anemic and just how “serious” the underlying pre-existing medical condition is that caused this to be.

Anemia defined:

Anemia is a condition in which the body does not have enough red blood cells or hemoglobin, a protein in red blood cells that carries oxygen to the body’s tissues. There are many different types of anemia, and they can be caused by a variety of factors, including:

- Blood loss: This can be due to injury, surgery, or a medical condition such as ulcers or cancer.

- Nutritional deficiency: Anemia can be caused by a deficiency of iron, folic acid, or vitamin B12. These nutrients are important for the production of red blood cells.

- Chronic disease: Anemia can be a complication of certain chronic diseases, such as kidney disease or rheumatoid arthritis.

- Inherited conditions: Some people are born with conditions that affect the production of red blood cells, such as sickle cell anemia or thalassemia.

Symptoms may include:

- Fatigue or weakness

- Shortness of breath

- Dizziness or lightheadedness

- Rapid heartbeat

- Pale skin

- Chest pain

- Cold hands and feet

- Headache

- Difficulty concentrating

- Irritability

Treatment options:

There are many treatment options for anemia, and the best course of treatment will depend on the underlying cause of the anemia. Some common treatment options for anemia include:

- Increasing iron intake: Iron supplements can help increase the body’s production of red blood cells.

- Taking folic acid or vitamin B12: These nutrients are important for the production of red blood cells.

- Treating the underlying cause: If anemia is caused by another medical condition, treating that condition can help improve the anemia.

- Blood transfusions: In severe cases of anemia, a person may need to receive blood transfusions to increase their red blood cell count.

- Erythropoietin medication: This medication can help stimulate the production of red blood cells.

What kind of information will the insurance companies ask me or be interested in?

Insurance companies may ask you a variety of questions related to your anemia in order to determine your eligibility for coverage and to assess the risk associated with insuring you. Some of the information they may ask for or be interested in includes:

-

- The underlying cause of your anemia: Insurance companies may ask about any medical conditions or lifestyle factors that may be contributing to your anemia.

- The severity of your anemia: Insurance companies may ask about the severity of your anemia, as this can impact your risk of complications and the likelihood that you will need medical treatment.

- Your treatment plan: Insurance companies may ask about the treatment plan recommended by your healthcare provider and may want to review any medical records related to your anemia.

- Your family medical history: Insurance companies may ask about the medical history of your family members, as certain medical conditions can run in families and may increase your risk of developing anemia or other health problems.

- Your occupation: Insurance companies may ask about your occupation, as certain occupations may be more physically demanding and may increase your risk of developing anemia or other health problems.

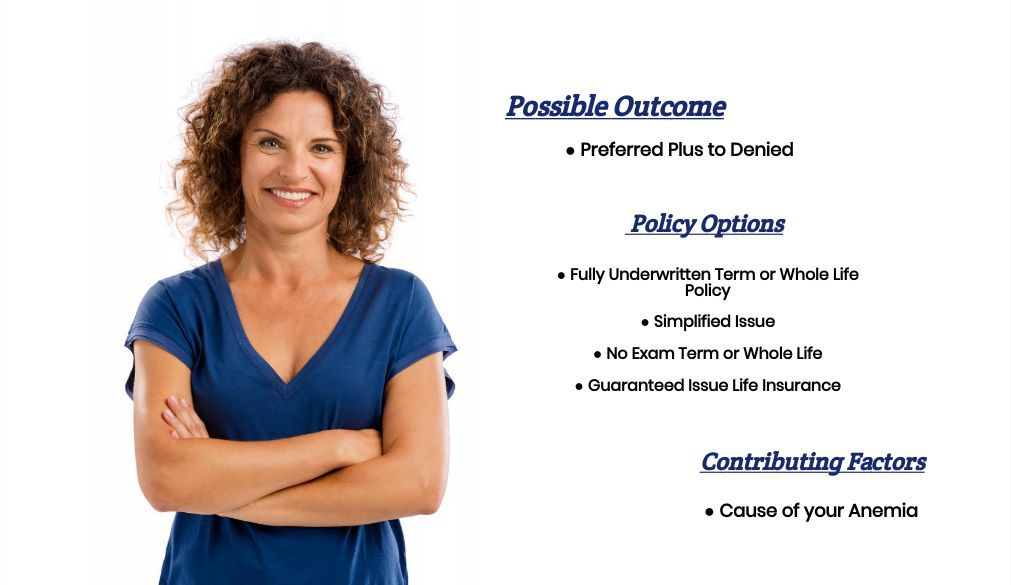

What rate class can I qualify for if I have Anemia?

As you can see, several factors can come into play when determining the type of rate you may qualify for when applying for life insurance. The questions we have listed above represent just the tip of the iceberg regarding all the factors that may affect your eligibility, depending on how you answer these initial questions.

Therefore, it is challenging to predict the rate you might qualify for without speaking with you directly. However, some assumptions can be made about anemia depending on its cause.

For example, if you have been diagnosed with anemia related to blood loss caused by an injury, normal menstruation, pregnancy, or a previously undiagnosed ulcer that has been treated or resolved, you may qualify for a preferred or preferred plus rate, assuming you meet other eligibility criteria.

Conversely, if you suffer from anemia due to a pre-existing condition where anemia is considered a symptom of a larger medical issue, anemia itself may not play a significant role in the outcome of your life insurance application. Instead, the underlying cause of your anemia will determine the rate you may qualify for.

Therefore, if your pre-existing condition has resolved, and you are no longer anemic at the time of your life insurance application, there is a good chance that your anemia will not affect your eligibility for life insurance. However, if your pre-existing condition is more severe or significant, it may impact the rate you qualify for.

Which brings us to the last topic that we wanted to take a moment and discuss with you, which is…

What can I do to help ensure that I get the “best life insurance” for me?

At IBUSA, we have found that those who take their time reviewing their life insurance options, ask a lot of questions, and seek out experienced agents, tend to find the best policy for them. It’s especially helpful to work with agents who have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions and have access to many different life insurance companies. This way, when it comes to more challenging cases, they don’t have to rely on a “one size fits all approach”.

While we may not be able to help everyone who has been previously diagnosed with anemia, IBUSA offers a wide variety of term and whole life insurance policies, as well as relationships with many top final expense insurance companies. So, in the event that someone isn’t able to qualify for a traditional life insurance policy, there may be other types of products available that they can qualify for.

If you’re interested in exploring your options, give us a call today!