In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Viagra or its generic form, Sildenafil, to treat their erectile dysfunction or ED.

Additionally, Viagra can also be used to treat pulmonary arterial hypertension, which is something that a life insurance underwriter will want to rule out before making any definitive decision about an individual’s life insurance application.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Viagra?

- Why do life insurance companies care if I’ve been prescribed Viagra?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Viagra?

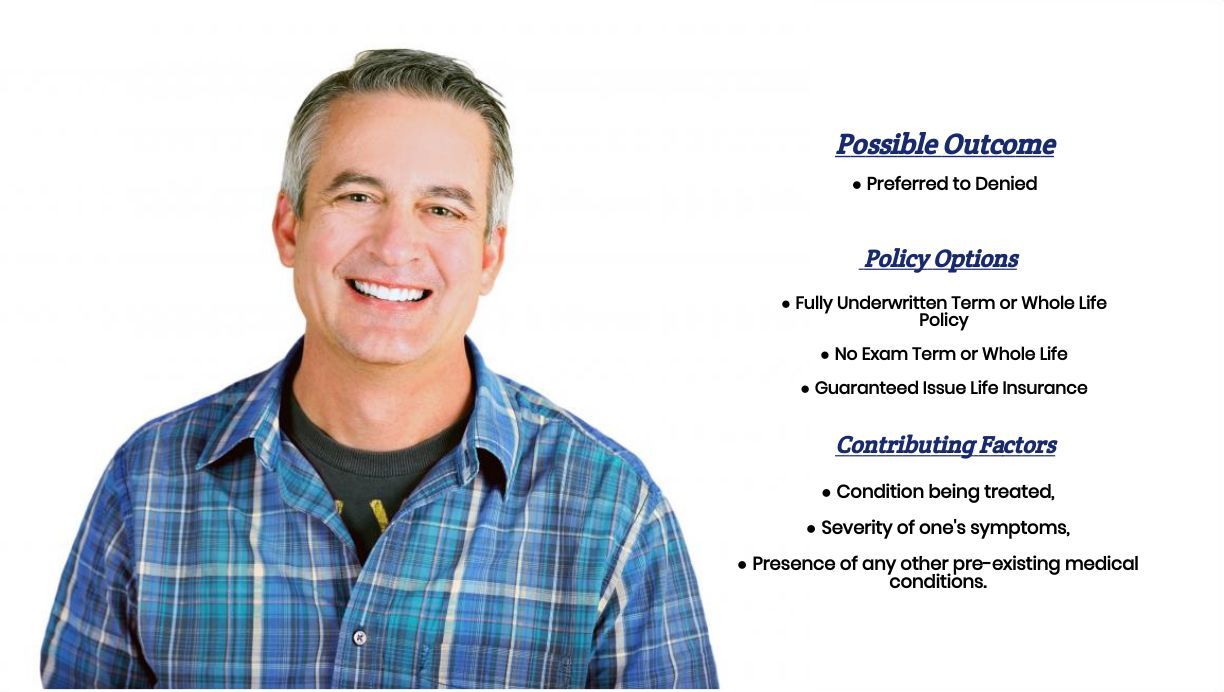

Yes, individuals who have been prescribed Viagra can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be eligible for a traditional term or whole life insurance policy.

Why do life insurance companies care if I’ve been prescribed Viagra?

When it comes to Viagra, what you’re typically going to find is that most life insurance companies aren’t going to be all that interested in the fact that you’ve been prescribed it, assuming that you’re only using it to treat erectile dysfunction (ED). This is because while suffering from ED may not be all that “fun,” it’s not something that is going to affect the outcome of your life insurance application.

That said, however…

Suppose you are using your Viagra to help you treat pulmonary arterial hypertension. In that case, there is a good chance that you’ll be asked about it, but what usually happens is that an insurance underwriter will discover this “other” pre-existing medical condition another way rather than through one’s prescription for Viagra, which is why at that point they’re really not going to spend a ton of time asking you questions about your Viagra.

Now, at this point, you might be wondering “how” a life insurance company might learn that you’ve been diagnosed with pulmonary arterial hypertension, erectile dysfunction, or any number of other possible pre-existing medical conditions, which is why it’s probably worth taking a moment and discussing what some of the questions you might be asked by an insurance company when applying for a traditional term or whole life insurance policy.

What kind of information will the insurance companies ask me or be interested in?

Life insurance companies have several ways to learn about a potential new customer. Ways such as:

- When ordering a prescription database, check to learn about what medications you have been prescribed in the past.

- Ordering a DMV check to learn about your diving history.

- Conducting a criminal background check to determine whether you have ever been convicted of a felony or misdemeanor.

I could possibly order a “credit check” as well. Then, on top of all this, most life insurance companies will also want to ask you questions. Questions such as:

- What’s your gender?

- When were you born?

- What is your current height and weight?

- Have you ever been diagnosed with a pre-existing medical condition?

- Have you ever been diagnosed with cancer, heart disease, or diabetes?

- Have you ever suffered from a heart attack or stroke?

- Have any of your immediate family members (mother, father, brother, or sister) ever been diagnosed with cancer, heart disease, or diabetes? Have any of them ever suffered from a heart attack or stroke?

- In the past 12 months, have you used any tobacco or nicotine products?

- Do you actively participate or plan on participating in any dangerous hobbies?

- In the past two years, have you ever declared bankruptcy?

- Do you have any issues with your driving record?

- Do you have any set plans to travel outside of the United States in the next year?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

As you can see, many factors can come into play when determining what kind of “rate” an individual can qualify for. Some will focus on medical issues, but as you can see, a surprising number of questions will also focus on “non-medical” issues.

This is why…

Without actually speaking to a person, it’s pretty much impossible to guess what kind of “rate” they might be able to qualify for. That said, however, what we can tell you is that if you’re only using your Viagra to help you treat erectile dysfunction, what you’re most likely going to find is that whatever “rate” you would have been able to qualify for before being prescribed Viagra should be the same rate that you would have been able to qualify for AFTER having been prescribed Viagra.

Where you’re Viagra…

The prescription might make a difference in cases where Viagra is used to treat pulmonary arterial hypertension, but even there, having been prescribed Viagra will most likely take a back seat to the fact that you have been diagnosed with such a potentially severe condition. This brings us to the last topic that we wanted to take a moment and discuss here in this article, which is…

How can I help ensure I get the “best life insurance” for me?

Because life insurance companies tend to use a lot of “random” factors in determining who they will and won’t insure and at what price, we here at IBUSA have found that the “best” way for us to be able to ensure that our clients can find the “best” life insurance policy that they can qualify for is to be sure to know our STUFF and offer a TON of options.

You see…

By employing only true life insurance professionals with tons of experience helping folks with all sorts of pre-existing medical conditions and providing them with many options to offer their clients, we here at IBUSA truly offer a one-stop shop for folks looking to protect their families.

Which is why, our advice to anyone looking to purchase a life insurance policy is to be sure that the insurance agent that they choose to work with is truly an expert and that they have dozens of options for you to consider because even if they are the greatest life insurance agent in the world if they don’t have access to the “best” life insurance policy for you what good is that going to do you?

So what are you waiting for? Call us today, and let us earn the right to protect your family!