Taking gabapentin for nerve pain, seizures, or other conditions shouldn’t derail your family’s financial security plans. Yet, many individuals discover conflicting information about how this commonly prescribed medication affects life insurance eligibility. The uncertainty intensifies when online searches suggest that any prescription medication automatically triggers higher premiums or potential coverage denials.

What most gabapentin users don’t realize is that this medication often has minimal impact on life insurance approvals when the underlying condition is well-managed and properly documented. So even though insurers will evaluate prescription medications you are taking during underwriting, gabapentin’s generally favorable safety profile and widespread medical acceptance will likely work in your favor.

In this guide, we’ll share what our analysis of gabapentin users has shown us, highlighting effective coverage options, from standard policies for stable conditions to specialized plans for complex medical histories. Hopefully, this will help you secure better rates and avoid overpriced coverage.

Medical Disclaimer

This article provides insurance guidance only and should not be considered medical advice. Always consult with your healthcare provider regarding medication decisions and your insurance broker for personalized coverage recommendations.

Table of Contents

About the Insurance Brokers USA Team

The Insurance Brokers USA Team consists of licensed insurance professionals with extensive experience helping clients with complex health conditions find appropriate coverage. Our agents have worked with hundreds, if not thousands, of individuals taking gabapentin for various conditions, specializing in alternative insurance solutions when traditional coverage isn’t available.

What Do Insurance Companies Know About Gabapentin?

Key insight: Insurance underwriters generally view gabapentin favorably compared to many other neurological medications due to its established safety profile and wide range of approved uses. Most major insurers have extensive data showing that gabapentin users, when properly managed, represent standard or near-standard risk levels.

Gabapentin, originally developed as an anti-seizure medication, has become one of the most commonly prescribed drugs for nerve-related pain conditions. Insurance companies recognize its legitimacy for treating diabetic neuropathy, post-herpetic neuralgia, restless leg syndrome, and seizure disorders. This broad acceptance works significantly in applicants’ favor during the underwriting process.

“Gabapentin has one of the most favorable underwriting profiles among neurological medications. When prescribed for accepted indications and well-tolerated by the patient, it rarely triggers automatic rate increases.”

– Senior Underwriter, InsuranceBrokers USA

The medication’s non-controlled substance status also eliminates concerns about dependency potential that insurers have with other pain medications. Most carriers understand that gabapentin users are managing legitimate medical conditions rather than seeking addictive substances.

Bottom Line

Insurance companies view gabapentin as a mainstream, medically necessary medication with minimal risk implications when properly prescribed and monitored.

How Do Insurers Evaluate Gabapentin Use?

Key insight: Underwriters focus primarily on the underlying condition being treated rather than the gabapentin itself. A person taking gabapentin for well-controlled diabetic neuropathy faces different evaluation criteria than someone using it for uncontrolled seizures.

The underwriting process examines several specific factors when gabapentin appears in your medical records. Insurance companies want to understand the original diagnosis, treatment response, dosage stability, and any side effects you’ve experienced.

Primary Underwriting Factors for Gabapentin Users

| Factor | Impact Level | Underwriter Concerns |

|---|---|---|

| Underlying Condition | High | Primary risk assessment focus |

| Treatment Response | Medium | Effectiveness and stability |

| Dosage Level | Low-Medium | Higher doses may indicate severity |

| Side Effects | Low | Functional impairment potential |

| Duration of Use | Low | Long-term stability indication |

Traditional underwriting approaches focus heavily on diagnostic codes and medication lists, but modern insurers increasingly recognize that gabapentin users often lead normal, productive lives. The key differentiator lies in demonstrating condition stability and medication effectiveness.

Our recommended strategy involves preparing comprehensive documentation that shows your condition’s management rather than simply listing gabapentin as a current medication. This proactive approach helps underwriters understand your situation’s context and stability.

Key Takeaways

- Underlying condition matters more than gabapentin itself

- Treatment stability and effectiveness are primary concerns

- Documentation quality significantly impacts underwriting decisions

- Proactive disclosure leads to better outcomes than reactive explanations

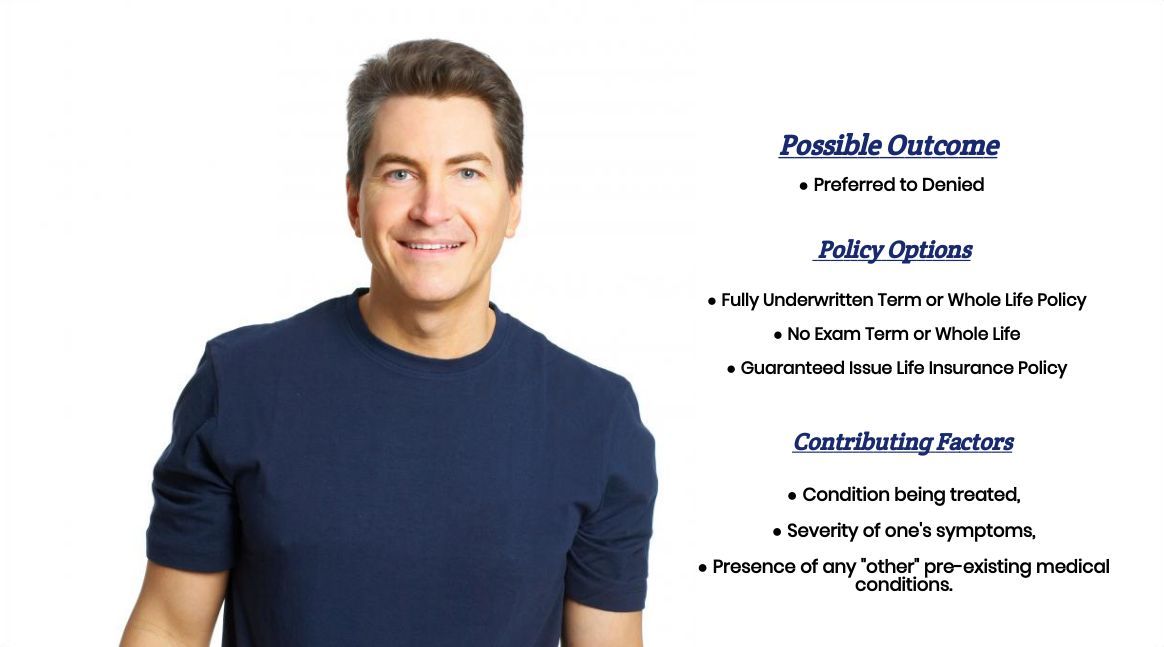

What Coverage Options Are Available?

Key insight: Gabapentin users typically qualify for the full spectrum of life insurance products, from traditional whole life policies to no-exam life insurance options, depending on their underlying health conditions and treatment stability.

The coverage landscape for gabapentin users has improved dramatically over the past decade as insurers gained more experience with the medication’s long-term safety profile. Most applicants discover they have more options than initially expected, particularly when their condition is well-managed.

“Start with traditional, fully underwritten policies before considering simplified issue products. Many gabapentin users qualify for standard rates when they expect to face restrictions.”

– Insurance Brokers USA Team Strategy

Traditional Life Insurance Policies

Fully underwritten policies remain the gold standard for gabapentin users who can demonstrate condition stability. These policies offer the lowest premiums and highest coverage amounts, making them ideal for individuals whose gabapentin use relates to well-controlled conditions like diabetic neuropathy or post-surgical nerve pain.

The application process involves medical exams and comprehensive health questionnaires, but this thorough evaluation often works in favor of stable gabapentin users. Underwriters can see the complete health picture rather than making assumptions based on limited information.

Simplified Issue Products

For individuals with more complex medical histories or those seeking faster approval processes, simplified issue life insurance provides an excellent middle ground. These products typically ask specific health questions without requiring medical exams, making them suitable for gabapentin users who might face complications with traditional underwriting.

Coverage amounts usually cap at $500,000, but approval decisions come within days rather than weeks. This option works particularly well for individuals whose gabapentin use relates to conditions that might trigger extensive medical record reviews in traditional underwriting.

Guaranteed Issue Options

Guaranteed issue policies serve as the coverage option of last resort for individuals who cannot qualify for other products. While these policies offer limited coverage amounts and include waiting periods, they provide valuable financial protection for gabapentin users with significant health complications.

Bottom Line

Most gabapentin users qualify for traditional life insurance policies at competitive rates, especially when their underlying condition is stable and well-documented.

How to Apply Successfully?

Key insight: Success in securing affordable life insurance while taking gabapentin depends more on application strategy and documentation preparation than on the specific medical details of your condition.

The most successful applications we’ve processed share common elements: thorough preparation, strategic insurer selection, and proactive communication about treatment benefits. Gabapentin users who approach the application process systematically consistently achieve better outcomes than those who apply reactively.

Pre-Application Preparation

Begin by gathering comprehensive medical documentation that demonstrates your condition’s stability and gabapentin’s effectiveness. Insurance companies want to see evidence that your treatment plan is working and that your condition isn’t progressively worsening.

Contact your prescribing physician to request a detailed summary letter explaining your diagnosis, treatment rationale, current status, and prognosis. This proactive documentation often prevents requests for additional medical records that could delay your application.

“The difference between a standard rate and a table rating often comes down to documentation quality. Gabapentin users who provide comprehensive medical summaries typically receive more favorable underwriting decisions.”

– InsuranceBrokers USA – Management Team

Strategic Timing Considerations

Apply for life insurance when your condition is most stable, ideally after several months of consistent gabapentin dosing without significant side effects. Avoid applying during periods of dosage adjustments or when exploring alternative treatments, as this can signal instability to underwriters.

For individuals managing pre-existing medical conditions, coordinate your life insurance application timing with your regular medical follow-ups to ensure all documentation reflects your current stable status.

Application Completion Best Practices

Answer all health questions completely and accurately, providing specific dates, dosages, and treatment responses where requested. Gabapentin users benefit from detailed disclosure because it demonstrates medical compliance and treatment awareness.

When describing your condition, focus on functional improvements and symptom management rather than the underlying diagnosis alone. Underwriters want to understand how gabapentin has improved your quality of life and daily functioning.

Key Takeaways

- Prepare comprehensive medical documentation before applying

- Time applications during periods of condition stability

- Focus on functional improvements in your health descriptions

- Work with experienced agents familiar with gabapentin cases

What Will Coverage Cost?

Key insight: Gabapentin use alone rarely increases life insurance premiums when the underlying condition is well-managed, but the specific diagnosis being treated can significantly impact pricing across different insurance companies.

Based on our analysis of hundreds of gabapentin-related applications, most clients receive standard or near-standard rates when their condition is stable and properly documented. The cost variations typically relate to the underlying medical condition rather than gabapentin itself.

Expected Rate Classifications by Condition

| Gabapentin Indication | Typical Rate Class | Premium Impact |

|---|---|---|

| Diabetic Neuropathy (controlled diabetes) | Standard Plus – Standard | 0-25% increase |

| Post-Herpetic Neuralgia | Standard Plus – Standard | 0-15% increase |

| Restless Leg Syndrome | Standard Plus | No increase |

| Epilepsy (well-controlled) | Standard – Table 2 | 25-50% increase |

| Fibromyalgia | Standard – Table 4 | 25-100% increase |

The key factor determining your premium isn’t gabapentin use but rather how well your underlying condition is managed and documented. Insurance companies have extensive actuarial data showing that gabapentin users with stable conditions represent normal mortality risks.

Factors That Influence Pricing

Several specific elements affect premium calculations for gabapentin users beyond the basic diagnosis. Treatment duration, dosage stability, side effect management, and functional improvement all play roles in underwriting decisions.

Individuals who demonstrate clear benefits from gabapentin treatment often receive more favorable rates than those whose response is unclear or poorly documented. This emphasizes the importance of maintaining detailed medical records that show treatment effectiveness.

“Shop multiple carriers for gabapentin cases. Rate variations can exceed 50% between companies based on their specific underwriting guidelines for neurological conditions.”

– Insurance Brokers USA Team

For individuals seeking the most competitive rates, working with brokers who have access to multiple top life insurance companies provides significant advantages. Different insurers have varying comfort levels with specific gabapentin indications, making company selection crucial for optimal pricing.

Bottom Line

Gabapentin users with well-managed conditions typically pay standard life insurance rates, with any premium increases relating to the underlying diagnosis rather than the medication itself.

Which Companies Offer the Best Rates?

Key insight: Insurance company attitudes toward gabapentin vary significantly based on their underwriting philosophy, actuarial experience, and target market focus. What constitutes a decline at one company might receive standard rates at another.

Our analysis of our gabapentin-related applications reveals distinct patterns in company preferences and underwriting approaches. Understanding these differences enables strategic application targeting that maximizes approval chances while minimizing premium costs.

Companies Favorable to Gabapentin Users

Several major insurers have developed particularly accommodating underwriting guidelines for gabapentin users, recognizing the medication’s mainstream acceptance and favorable long-term outcomes data.

These companies typically focus on functional assessment rather than diagnostic labeling, evaluating how well applicants manage their conditions rather than penalizing them for requiring medication management. This approach significantly benefits gabapentin users who can demonstrate stable, effective treatment.

Traditional Conservative Approaches

Some insurers maintain more cautious approaches to neurological medications, including gabapentin, particularly when prescribed for conditions like fibromyalgia or chronic pain syndromes. These companies may require additional medical information or apply higher rate classifications.

Understanding which companies take conservative approaches helps avoid unnecessary applications that might result in declines or expensive rate classifications. Strategic company selection becomes particularly important for individuals with complex medical histories.

“Company selection matters more for gabapentin users than most people realize. The right insurer can mean the difference between standard rates and table ratings for identical medical situations.”

– InsuranceBrokers USA – Management Team

Emerging Market Opportunities

Several newer entrants to the life insurance market have developed innovative underwriting approaches that particularly benefit individuals with well-managed chronic conditions. These companies often use accelerated underwriting processes that focus on prescription adherence and treatment effectiveness.

For gabapentin users, these emerging opportunities can provide both faster approvals and competitive rates, especially for individuals whose conditions are stable but might require extensive documentation with traditional insurers.

Working with brokers who understand the evolving landscape helps gabapentin users access these emerging opportunities while avoiding companies with outdated underwriting guidelines. Our team at 888-211-6171 maintains current knowledge of which insurers offer the most favorable terms for specific gabapentin indications.

Key Takeaways

- Company selection significantly impacts approval odds and premium costs

- Some insurers specialize in applicants with managed chronic conditions

- Emerging market players often offer innovative underwriting approaches

- Broker expertise in company preferences proves invaluable for optimal outcomes

What Documentation Do You Need?

Key insight: Comprehensive documentation that demonstrates gabapentin’s effectiveness and your condition’s stability typically results in faster approvals and better rate classifications than minimal disclosure approaches.

The documentation process for gabapentin users should focus on painting a complete picture of treatment success rather than simply listing medications and diagnoses. Insurance companies want to understand the context, effectiveness, and stability of your treatment plan.

Essential Medical Records

Start with a current physician summary letter that explains your original diagnosis, treatment rationale, current status, and prognosis. This summary should specifically address how gabapentin has improved your condition and quality of life.

Include recent medical records that show stable dosing, good tolerance, and effective symptom management. Laboratory results, specialist consultations, and treatment response documentation all contribute to a favorable underwriting review.

Documentation Checklist for Gabapentin Users

- Physician Summary Letter: Current treatment status and prognosis

- Prescription History: Dosage stability and compliance record

- Diagnostic Documentation: Original diagnosis and any updates

- Treatment Response Records: Symptom improvement documentation

- Specialist Reports: Neurologist or pain management evaluations

- Functional Assessment: Daily activity and work capability status

- Laboratory Results: Recent tests showing stable health markers

Proactive Communication Strategies

Prepare a personal statement explaining your experience with gabapentin, including when treatment began, how it has helped your condition, and any lifestyle improvements you’ve experienced. This narrative helps underwriters understand the human impact of successful treatment.

Address any concerns proactively, such as side effects you’ve experienced and how they’re managed, or periods of dosage adjustment and why they occurred. Transparency about challenges demonstrates medical awareness and compliance.

“Documentation quality often determines whether a gabapentin user receives standard rates or faces table ratings. Invest time in gathering comprehensive records before applying.”

– Insurance Brokers USA Team

Timing Documentation Requests

Request medical records and physician letters well in advance of your application to ensure current, comprehensive documentation. Many physicians require several weeks to prepare detailed summary letters, and outdated records can trigger requests for updates.

Coordinate with your healthcare providers to ensure all documentation reflects your most recent stable status. For individuals considering final expense insurance options, simplified documentation requirements may make the application process more manageable.

Bottom Line

Thorough documentation that demonstrates gabapentin’s effectiveness and your condition’s stability significantly improves your chances of securing favorable life insurance rates.

What Mistakes Should You Avoid?

Key insight: The most costly mistakes gabapentin users make involve application timing, company selection, and documentation preparation rather than medical factors beyond their control.

Our analysis of challenging cases reveals patterns of avoidable errors that lead to higher premiums or coverage denials. Understanding these common pitfalls helps gabapentin users navigate the application process more successfully.

Application Timing Errors

Applying for life insurance during periods of medication adjustment or dosage changes signals instability to underwriters, even when changes represent improvements in treatment. Wait until your gabapentin regimen has been stable for at least three months before applying.

Similarly, avoid applying immediately after diagnosis or while exploring alternative treatments. Insurance companies prefer to see established treatment patterns and clear evidence of medication effectiveness.

“Many gabapentin users apply too soon after starting treatment or during dosage adjustments. Patience in timing can result in significantly better rate classifications.”

– Senior InsuranceBrokers USA Agent

Disclosure and Communication Issues

Incomplete disclosure about gabapentin use or the underlying condition creates problems during underwriting review. Insurance companies access prescription databases and medical records, making incomplete information discovery almost inevitable.

Focus on positive aspects of your treatment without minimizing the seriousness of your condition. Underwriters appreciate honesty about challenges while recognizing successful management and improvement.

Company Selection Problems

Applying to the wrong insurance company based on advertised rates or brand recognition rather than underwriting philosophy toward gabapentin users leads to unnecessary denials or expensive rate classifications.

Each insurer has specific strengths and weaknesses in evaluating different medical conditions. Working with experienced brokers who understand these nuances helps avoid companies that might view your situation unfavorably.

Documentation Preparation Oversights

Submitting minimal documentation and waiting for insurance companies to request additional information creates delays and may result in less favorable underwriting decisions. Comprehensive initial submissions demonstrate preparation and medical awareness.

Failing to obtain current physician letters or relying on outdated medical records can trigger extensive additional requirements that extend the underwriting process unnecessarily.

Key Takeaways

- Wait for treatment stability before applying for coverage

- Provide complete, honest disclosure about your condition and treatment

- Choose insurers based on underwriting philosophy, not just advertised rates

- Prepare comprehensive documentation before starting the application process

Bottom Line

Avoiding common application mistakes through proper timing, complete disclosure, strategic company selection, and thorough documentation preparation significantly improves your chances of securing affordable life insurance coverage.

Frequently Asked Questions

Can I get life insurance if I take gabapentin?

Yes, most gabapentin users qualify for life insurance coverage. The medication itself rarely prevents approval when the underlying condition is well-managed. Success depends more on your specific diagnosis, treatment stability, and overall health status than gabapentin use alone.

Will gabapentin use increase my life insurance premiums?

Gabapentin itself typically doesn’t increase premiums significantly. Any rate adjustments usually relate to the underlying condition being treated rather than the medication. Many users with stable conditions receive standard rates, especially for diagnoses like diabetic neuropathy or post-surgical nerve pain.

Should I disclose gabapentin use on my application?

Always disclose all medications completely and honestly. Insurance companies access prescription databases during underwriting, making discovery of undisclosed medications almost certain. Complete disclosure demonstrates integrity and allows for proper evaluation of your situation.

How long should I wait after starting gabapentin before applying?

Wait at least 3-6 months after achieving stable dosing. Insurance companies prefer to see established treatment patterns and clear evidence of medication effectiveness. Applying during adjustment periods can signal instability to underwriters.

Which insurance companies are best for gabapentin users?

Company selection depends on your specific underlying condition and treatment history. Some insurers specialize in applicants with managed chronic conditions, while others take more conservative approaches. Working with experienced brokers helps identify the most favorable options for your situation.

Do I need a medical exam if I take gabapentin?

Medical exam requirements depend on coverage amount and insurer policies, not gabapentin use. Many gabapentin users qualify for no-exam life insurance options up to certain coverage limits, while larger policies typically require exams regardless of medication use.

What documentation should I prepare for my application?

Gather comprehensive medical records showing treatment stability and effectiveness. Include current physician summary letters, prescription history, diagnostic documentation, and evidence of symptom improvement. Thorough documentation often leads to faster approvals and better rates.

Can I get coverage if gabapentin isn’t helping my condition?

Coverage is still possible, but it may be more challenging. Insurers prefer to see evidence of effective treatment, but unsuccessful medication trials don’t automatically disqualify you. Consider working with specialists who handle complex medical cases and alternative insurance products.

I had tongue cancer 6 years ago. I am cancer free now. I take gabapentin to help control pain caused by radiation. Two companies have denied me. I don’t know if this is the reason for sure.

Kathi,

If you give us a call, we’d be happy to take a look and see if we might have a carrier that would insure you.

Thanks,

InsuranceBrokersUSA