In this article, we wanted to take a moment and try and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Eskalith or its generic form, Lithium Carbonate, to help treat manic episodes associated with either Manic Depression or Bipolar Disorder.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Eskalith?

- Why do life insurance companies care if I’ve been prescribed Eskalith?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance after I’ve been prescribed Eskalith?

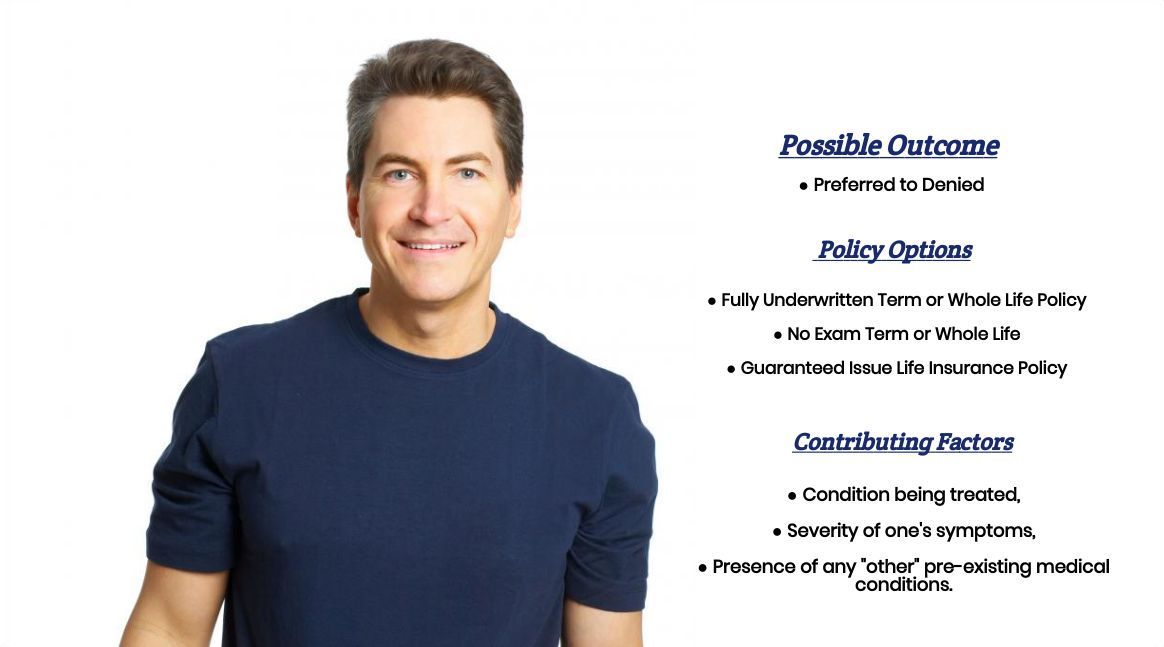

Yes, individuals who have been prescribed Eskalith can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a Preferred rate on occasion! That said, however, the presence of Eskalith on a life insurance application certainly isn’t going to make qualifying for a traditional life insurance policy any easier, which is why it’s important to not only understand “how” life insurance companies view Eskalith in general as well as be sure that your life insurance agent is familiar with helping folks like yourself qualify for the “best” life insurance policy that you can qualify for.

Why do life insurance companies care if I’ve been prescribed Eskalith?

Life insurance companies “care” if an individual has been prescribed Eskalith because Eskalith is a prescription medication that is really only used to help folks prevent or manage “manic” episodes, which constitute a pre-existing medical condition that life insurance companies are VERY interested in.

Now, the good news is that being diagnosed with bipolar disorder or manic depression isn’t like being diagnosed with some other “kind” of “life-threatening” medical condition, but both of these pre-existing medical conditions are considered “serious enough” to warrant you to either have to pay more for your life insurance policy or just be denied coverage entirely.

This is why…

Most (if not all) life insurance companies are going to want to ask you a series of questions about your Eskalith prescription and the pre-existing medical condition that it is being used to treat prior to making any kind of decision about the outcome of your life insurance application. Because the truth is both manic depression and bipolar disorder will affect different people very differently. Some individuals may be able to control and manage their condition with very little effort, in which case they may be able to qualify for coverage with very little difficulty. While others may find it difficult to cope with their disorder or may have had times in their lives when their condition went “unmanaged,” in which case qualifying for coverage may be much more difficult.

The good news is that…

Here at IBUSA, have plenty of experience working with both “types” of applicants and know many of the questions the life insurance companies are going to ask prior to actually applying for coverage which puts us in a much better position to not only answer these questions for you right away but also to help “steer you” towards a company that might provide you with a much better opportunity for success.

What kind of information will the insurance companies ask me or be interested in?

- When were you first prescribed Eskalith?

- Who prescribed your Eskalith? A general practitioner or a psychiatrist?

- Have you been given an “official” diagnosis? And if so, what is it?

- How well has your Eskalith helped you manage your manic symptoms?

- When was the last time you suffered from a manic episode?

- In the past year, how many manic episodes have you suffered from (if any)?

- Have you ever needed to be hospitalized due to your condition?

- Are you taking any other prescription medications to help you treat your condition?

- In the past 12 months, have any of your prescription medications changed in any way?

- Do you have any history of drug or alcohol abuse?

- Have you ever been convicted of a felony or misdemeanor?

- Do you have any issues with your driver’s license, such as multiple moving violations, a DUI, or a suspended license?

- Do you actively participate, or do you plan on participating in any dangerous hobbies such as skydiving, hang gliding, or bungee jumping?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

Here at IBUSA, what we have found is that if an individual has been diagnosed with either bipolar disorder or manic depression, they can still qualify for a traditional term or whole life insurance policy.

Usually, what happens is…

If an individual has been “symptom-free” for at least a year, many life insurance companies will then begin to consider this person “potentially” eligible for a Standard or Standard Plus rate. Preferred rates are possible; however, most (if not all) life insurance companies would like to see an individual be symptom-free for longer than a year and be in exceptional health in all other areas.

Now as for those who may not be “totally” symptom-free for a least a year, or many have lingering baggage from a time when they didn’t have their condition fully under control, chances are you will not be able to qualify for a Standard rate and will therefore need to “settle” for a lower rate or a “higher risk” rate.

It is here where…

Choosing to work with a life insurance professional who has access to dozens of different life insurance companies could make all the difference because not only will he or she know “which” life insurance policy might be the best for you, but they’ll also have access to many different companies some of which may be much more lenient to those suffering from a pre-existing medical condition like bipolar disorder or manic depression. This brings us to the last topic that we wanted to take a moment and discuss here today, which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance profession who will work as an advocate for you. Such an agent who can help guide you through the application process and be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because, after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now does it?

Lastly, you’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”

So, what are you waiting for? Give us a call today and see what we can do for you!