In this article, we wanted to take a moment and answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Actos or its generic form Pioglitazone to treat their type 2 diabetes.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Actos or ACTOplus Met?

- Why do life insurance companies care if I’ve been prescribed Actos or ACTOplus Met?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Actos or ACTOplus Met?

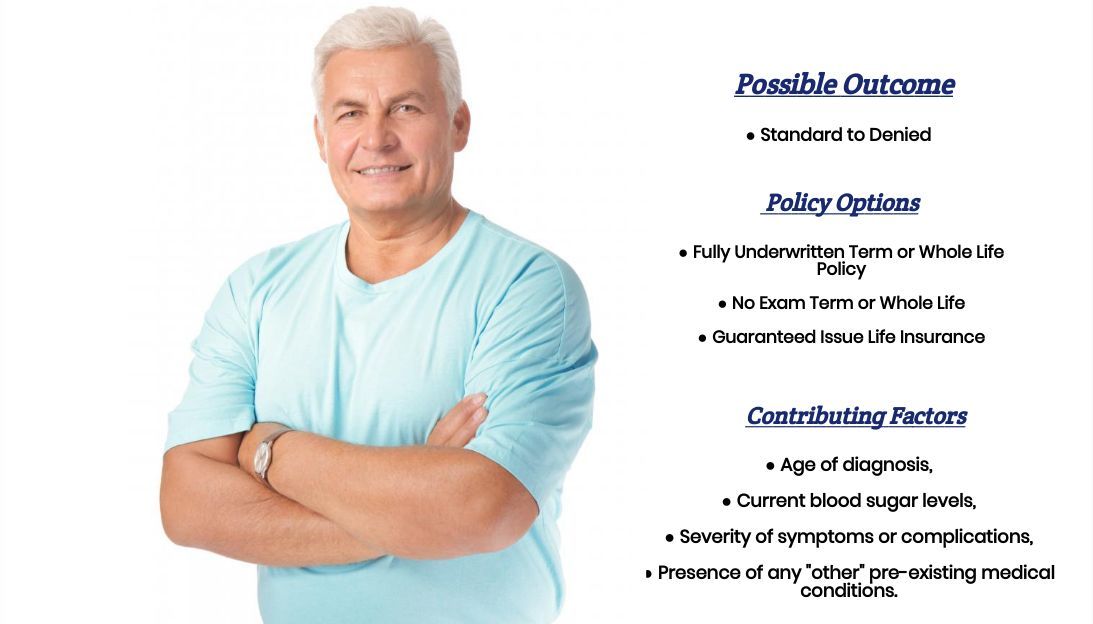

Yes, individuals who have been prescribed Actos or ACTOplus Met, can and often will be able to qualify for a traditional life insurance policy. In fact, some may even be able to qualify for a no medical exam term life insurance as well!

The only problem is…

That even though someone with an Actos prescription will “technically” still be able to qualify for coverage, that doesn’t mean that they’re life insurance application isn’t going to be more “complicated” than those who aren’t taking Actos.

This isn’t a big deal; it just means that you’re going to want to be a bit more “selective” before you decide to apply for coverage; otherwise, you may find yourself having to pay more for your coverage or even worse Denied!

Why do life insurance companies care if I’ve been prescribed Actos or ACTOplus Met?

When it comes to working with folks who have been diagnosed with type 2 diabetes, it’s not all that uncommon for someone to tell us that they’re not actually “diabetic” they’re just “pre-diabetic.” And that if we actually reached out to their primary doctor, he or she would tell us the same.

“Which is all fine and dandy!”

However…

When it comes to purchasing a traditional term or whole life insurance policy, if you’ve been prescribed a medication to help you control your blood sugar, you are a diabetic.

Now you may be…

A really well-controlled diabetic, which is great, but an insurance company is still going to consider you a diabetic.

This is why…

Most of the best life insurance companies are going to “care” if you’ve been prescribed either Actos or ACTOSplus Met because this will let them know right away that you have been previously diagnosed with Diabetes.

The good news is that both Actos and ACTOSplus Met are both oral medications, which will work in your favor when it comes time to determine what kind of “rate you will qualify for.

The problem only is…

That before any life insurance company is going to be willing to move forward with your life insurance application; they’re now going to want to ask you a series of questions about your Diabetes.

This way…

They can get a better idea of how well you are managing your type 2 diabetes and whether or not you are suffering from any other disease symptoms other than elevated blood sugar levels.

What kind of information will the insurance companies ask me or be interested in?

Once it has been discovered that you have been prescribed Actos or ACTOSplus Met, most (if not all) life insurance companies are going to want to try and determine how well you are managing your condition. To do so, they may want to order medical records from your primary care physician, but they will usually try to first learn all they need to know by asking questions such as:

- When were you first diagnosed with Diabetes?

- What kind of Diabetes have you been diagnosed with?

- Do you monitor your blood sugar daily? And if so, what is your daily average?

- When was the last time you had your A1C checked? What was that value?

- How often do you see your primary care physician?

- Is Actos or ACTOSplus Met the only medication(s) that you’re using to treat your Diabetes?

- How well is it controlling your condition?

- Are you experiencing any complications from your Diabetes such as: nerve pain, numbness or tingling of the hand and feet, etc…

- In the past 12 months, have any of the medications that you’re using to treat your Diabetes changed in any way?

- What are your current height and weight?

- In the past 12 months, have you used any tobacco or nicotine products?

- Are you currently working now?

- In the past 12 months, have you applied or received any form of disability benefits?

What rate (or price) can I qualify for?

While it is possible for some folks who have been diagnosed with type 2 diabetes to be able to qualify for a Standard or “Normal” rate, these cases are certainly not the “Norm.”

Instead, when we here at IBUSA typically advise that most “well controlled” type 2 diabetic applicants will most likely qualify for what is called a “Table B” rating.

Which begs the question…

“What’s a Table B rating?”

There are over 16 different rate classes an individual can qualify for when applying for a traditional life insurance policy. Preferred or Preferred Plus being the best, followed by Standard or Standard Plus. From there, you then enter into what are called Table Ratings. In total, there are ten different “tables” one can rank for. They range from Table A (which would be the “best” or least expensive table) to Table J (which would be considered the “worst” or most expensive table.

Now…

We’re not going to “sugar coat” it, not being able to qualify for a Standard or better rate is going to cost more than it would if you could qualify for those “better” rates.

However, we should point out that it’s also not the end of the world either because there are many life insurance companies out there that make a living off of offering very competitive rates at these so-called “higher risk” classifications.

The trick then becomes…

Knowing which companies offer the “best” table rate pricing and which companies will allow you to qualify for the “best” table rate. You see, not all life insurance companies are going to be necessarily all that “friendly” toward diabetic applicants.

Which means that while you may be able to qualify for a Table B with one company that does not mean that you’ll be able to qualify for a Table B with every life insurance company.

Additionally…

If it turns out that your Diabetes isn’t necessarily the “best” managed, you may even find that some life insurance companies may not be willing to offer you a policy even at a high table rate! Which brings us to the final topic that we wanted to cover here in this article which is…

What can I do to help ensure that I get the “best life insurance” for me?

Anytime we speak with an individual who has been diagnosed with a pre-existing medical condition like type 2 diabetes, the first thing that we like to do is encourage them to take their time. This is because while it’s certainly possible to qualify for a traditional life insurance policy at a great rate, you’re going to want to make sure you do your homework before you just decide to apply for coverage right away.

And this homework…

Starts by making sure that the life insurance agent that you choose to work with is a true-life insurance professional and not someone who is simply “manning the phones” in some large call center.

Now we don’t…

Necessarily have anything against those large call center agencies because they certainly do help out a lot of folks, it’s just that in cases where an application may need some additional TLC, working in an environment like that may not be the most conducive for you.

But…

Perhaps you have already called one of these larger firms, and have found an incredible agent (which is certainly possible)! The next step would be to make sure that he or she has access to a wide variety of different insurance companies to choose from because it doesn’t matter if you’ve partnered up with the greatest life insurance agent in the world if he or she doesn’t have access to the “best” life insurance policy for you.

This is why…

We here at IBUSA have worked so hard to first make sure that we only employ the “best” agents in the industry, but also make sure that we continually seek out relationships with the “best” life insurance companies in the industry.

This way….

When it comes time to helping our more “challenging” clients find the help they need, we don’t have to just rely on one or two different options!

Now, will we be able to help out everyone who has been prescribed Actos?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available to you, just give us a call!