In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with a Bicuspid Aortic Valve (BAV).

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been diagnosed with Bicuspid Aortic Valve (BVA)?

- Why do life insurance companies care if I’ve been diagnosed with Bicuspid Aortic Valve (BVA)?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance”?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been diagnosed with Bicuspid Aortic Valve (BVA)?

Yes, it is possible to qualify for life insurance after being diagnosed with a pre-existing medical condition like a bicuspid aortic valve (BVA). However, your diagnosis may affect the terms of your policy and the premiums you will pay. After all, BVA is a congenital heart condition in which the aortic valve regulates blood flow from the heart to the rest of the body, so it’s understandable why life insurance companies would have their concerns.

In fact…

Most top-rated life insurance companies will consider a wide variety of factors when determining eligibility and premiums for life insurance policies, including age, gender, medical history, and lifestyle. So, if you have been diagnosed with BVA, you shouldn’t be too concerned if the insurance company asks you for more information about your condition and how it is managed because it is simply their way of understanding your condition.

It is also worth noting that different insurance companies have different underwriting guidelines and may have different approaches to assessing risk for individuals with BVA.

That said, however…

Oe thing that we have consistently found is that even though it may be possible for someone who has been diagnosed with a BVA to be able to qualify for a no medical exam term life insurance policy, when they do, it’s usually at a rate that is worse than they would have been able to qualify for had they applied for a fully underwritten (exam required) policy.

Why do life insurance companies care if I’ve been diagnosed with Bicuspid Aortic Valve (BVA)?

It’s fair to say that just about any time an individual has been diagnosed with some “kind” of pre-existing medical condition that affects one’s heart, most life insurance companies are going to take an active “interest” in wanting to know more about “that” condition and how “serious” it might be.

And who…

Can we blame them? After all, the role of the life insurance underwriter, who will be the one who determines whether or not you can qualify for a life insurance policy, is to access and minimize risk to their employer. This is why it only makes sense that having been diagnosed with bicuspid aortic valve disease might be an issue. To better understand why, it makes sense to take a moment and review precisely what a bicuspid aortic valve is and how having one can have some pretty significant consequences for one’s overall health.

Bicuspid Aortic Valve (BVA) Defined:

As stated, a bicuspid aortic valve is the most common congenital heart defect that an individual can suffer from and is defined by an aortic valve that only has two “leaflets” as opposed to three, which is the norm.

Fortunately…

For many, this defect may not produce any symptoms, so they may live their entire life without knowing they suffer. For others, however, having a bicuspid aortic valve may result in the development of:

- Aortic stenosis is a condition where, over time, calcium can build up on the valve itself, causing it to harden and become less flexible.

- Aortic regurgitation is also referred to as aortic valve insufficiency.

- Coarctation or the narrowing of the aorta,

As well as possibly developing an aortic aneurysm. All of these could potentially develop into what could eventually become a life-threatening medical condition!

Symptoms of this disorder may include:

- Difficulty breathing,

- Chest pain,

- Fatigue,

- Dizziness or lightheadedness,

- Fainting,

- Heart palpitations,

- Swelling of the lower extremities,

- Etc, etc…

The good news is…

For those who do end up suffering from noticeable symptoms of this disease or are considered to be at an increased risk of some “kind” of more serious cardiovascular disease as a result of this disorder, there are treatment options that will correct this condition.

Unfortunately, most will require some surgical procedure, but given the alternative, it is nice to know you may have options if needed.

This also explains…

Why most (if not all) life insurance underwriters aren’t going to be satisfied just knowing that you have been diagnosed with bicuspid aortic valve disease?

Before a life insurance company is willing to decide on your life insurance application, they will want to know a lot more about you and how “serious” your condition might be before they are willing to make any decision about your life insurance application.

What kind of information will the insurance companies ask me or be interested in?

When applying for life insurance, you will typically be required to complete an application with questions about your personal and medical history.

If you have been diagnosed with a bicuspid aortic valve (BVA), the insurance company may ask for more information about your condition and how it is managed. Some of the information they may request includes:

- Details about your diagnosis, including when, what symptoms you experience, and the severity of your condition.

- Information about your treatment, including any medications you are taking, lifestyle changes you have made to manage your condition, and any surgical procedures you have undergone.

- Any additional medical conditions you have and your family medical history.

- Your current and past occupation and any hazardous activities you engage in as part of your work or leisure activities.

- Your lifestyle habits, including your diet, exercise routine, and use of tobacco or alcohol.

It is important to be honest and accurate when answering these questions, as this information will be used to determine your eligibility for a life insurance policy and the premiums you will pay. If you do not disclose your BVA diagnosis and it is discovered later, it could affect your coverage or your policy payout.

It is also a good idea to have a copy of your medical records and a list of medications you take when applying for life insurance. This can help the insurance company better understand your condition and its management.

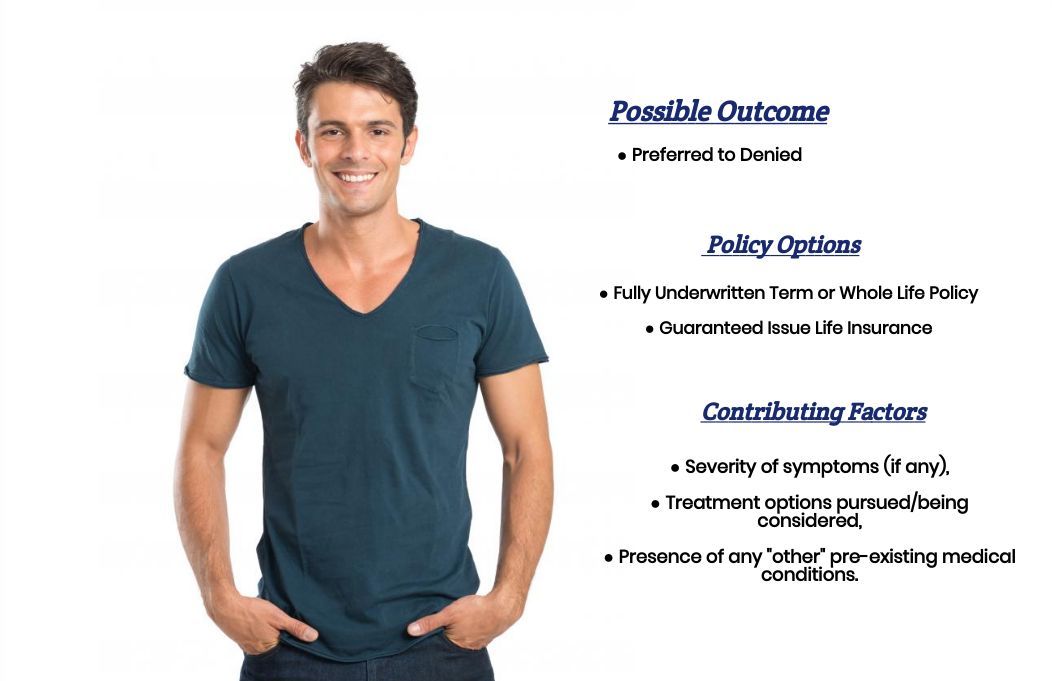

What rate (or price) can I qualify for?

As you can see, many potential variables can come into play when it comes time to determine what kind of “rate” an individual might qualify for after being diagnosed with bicuspid aortic valve disease. This is why it is impossible to know what “kind” rate you might qualify for without first speaking with you directly. That said, however, there are a few “assumptions” that we can make about those who have been diagnosed with bicuspid aortic valve disease, which will generally hold.

Particularly if your bicuspid aortic valve disease isn’t causing you to suffer from any symptoms, and your doctor doesn’t feel that you need to receive any treatment for your condition.

For folks like these…

You’ll generally find that insurance companies will consider your bicuspid aortic valve disease diagnosis a “non-factor” in determining what kind of rate you might qualify for. Or, in other words, whatever “rate” you might have been able to qualify for before your diagnosis out to be the same rate you could qualify for AFTER your diagnosis.

Which means…

We only run into trouble when someone is beginning to experience symptoms directly related to their bicuspid aortic valve disease. In cases like these, the “severity” of the symptoms being experienced will generally determine what kind of “rate” an individual might qualify for and whether or not they can be eligible for a traditional term or whole life insurance policy!

The good news is…

Regardless of your situation, we here at IBUSA can help because we have tons of experience helping folks with pre-existing medical conditions like yours. We are committed to helping all our clients find the “best” life insurance policy they can qualify for.

This brings us to the last topic that we wanted to take a moment and discuss, which is…

How can I help ensure I get the “best life insurance” for me?

In our experience here at IBUSA, we have found that usually, the folks who seem to see the “best” life insurance policy for them are those that:

- Take their time reviewing their options.

- Ask a lot of questions.

Seek out those life insurance agents who not only have experience working with individuals who have been diagnosed with a wide variety of pre-existing medical conditions but also have access to dozens of different life insurance companies so that when it comes time to help a more “challenging” case, they don’t have to rely on a…

“One size fits all approach!”

The good news is that this is precisely what you’ll find here at IBUSA.

Can we help out everyone previously diagnosed with a Bicuspid Aortic Valve?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance companies so that if someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to see what options might be available, call us!