When your cardiologist first mentioned “bicuspid aortic valve,” the medical terminology might have felt a bit overwhelming – but now you’re wondering how this congenital heart condition affects your ability to secure life insurance for your family’s protection. Sadly, your searches on the internet are likely going to offer conflicting advice, ranging from “impossible to get coverage” to vague promises about “specialized policies,” leaving you uncertain about realistic options.

What many individuals don’t realize is that having a bicuspid aortic valve doesn’t automatically disqualify you from life insurance coverage. While underwriters approach heart conditions with careful scrutiny, numerous coverage paths exist depending on your valve function, symptoms, and treatment history. Our analysis of hundreds of applications reveals the specific strategies that work for individuals with a bicuspid aortic valve, from standard policies for those with excellent valve function to specialized products for those requiring surgical intervention.

What Is a Bicuspid Aortic Valve and How Do Insurers View It?

A bicuspid aortic valve is a congenital heart condition where the aortic valve has two leaflets instead of the normal three, affecting approximately 1-2% of the population. This structural difference can lead to valve stenosis (narrowing) or regurgitation (leaking) over time, though many individuals live normal lives without symptoms.

Bottom Line

Insurance companies view a bicuspid aortic valve as a manageable risk when valve function remains normal and no symptoms are present. The key is demonstrating stable conditions through recent cardiac evaluations.

How Insurance Companies Assess Heart Valve Conditions

Key insight: Insurers focus primarily on functional impact rather than the mere presence of the condition. Their evaluation typically centers on:

- Current valve function: Severity of stenosis or regurgitation based on echocardiogram results

- Symptom presence: Shortness of breath, chest pain, or exercise intolerance

- Treatment history: Whether surgical intervention has been required or recommended

- Associated complications: Development of arrhythmias or heart failure

- Family history: Genetic predisposition to aortic valve disease

“In our experiences involving bicuspid aortic valve, the single most important factor for approval is demonstrating stable valve function through recent cardiac testing. Applicants with normal or mildly abnormal function typically receive standard or slightly elevated rates.”

– InsuranceBrokers USA – Management Team

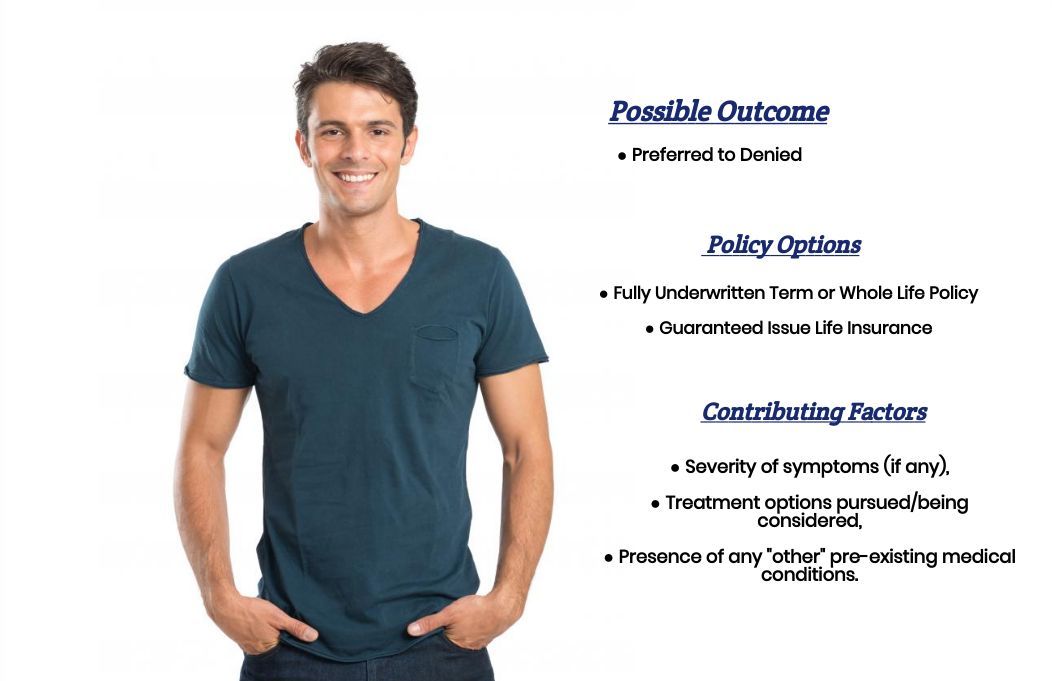

What Life Insurance Options Are Available?

Coverage options for a bicuspid aortic valve depend significantly on your current health status and valve function. The insurance landscape offers several pathways, each suited to different circumstances.

Traditional Fully Underwritten Policies

Best suited for individuals with well-controlled conditions and normal valve function. These policies offer the most comprehensive coverage and competitive rates when you qualify:

- Term life insurance: 10-30 year level premium periods with coverage amounts up to $5 million

- Whole life insurance: Permanent coverage with cash value accumulation

- Universal life insurance: Flexible premium permanent coverage with investment options

Bottom Line

Applicants with a bicuspid aortic valve and normal valve function can often qualify for standard rates on traditional policies, especially when no symptoms are present and cardiac testing shows stable results.

Simplified Issue Life Insurance

For individuals who face challenges with traditional underwriting, simplified issue policies provide accessible coverage with reduced medical requirements:

- Coverage amounts typically range from $25,000 to $500,000

- Health questions instead of medical exams

- Faster approval process (often within days)

- Higher premiums than fully underwritten policies

Guaranteed Issue Life Insurance

When other options aren’t available, guaranteed issue policies accept all applicants regardless of health conditions:

- No medical questions or health requirements

- Coverage limits typically $25,000 or less

- Two-year waiting period for natural death benefits

- Significantly higher premiums per dollar of coverage

Key Takeaways

- Traditional policies offer the best value when you qualify based on stable valve function

- Simplified issue provides middle-ground access for those with mild complications

- Guaranteed issue serves as last-resort coverage for complex cases

- Consider group life insurance through employers as additional coverage

What Factors Do Underwriters Consider Most Important?

Understanding underwriter priorities helps you prepare a stronger application and set realistic expectations for coverage outcomes. Based on our analysis of successful applications, certain factors carry significantly more weight in the decision process.

Primary Underwriting Factors for Bicuspid Aortic Valve

| Factor | Impact Level | Favorable Outcome |

|---|---|---|

| Current valve function | Critical | Normal or mild dysfunction |

| Symptom status | Critical | Asymptomatic |

| Recent cardiac testing | High | Within 12 months, stable results |

| Surgical history | High | No surgery required |

| Age at diagnosis | Moderate | Diagnosed in adulthood |

| Exercise tolerance | Moderate | Normal activity level |

Medical Records Requirements

Key insight: Comprehensive documentation significantly improves approval chances. Underwriters typically request:

- Echocardiogram reports: Most recent study showing valve function measurements

- Cardiology consultation notes: Specialist assessments and treatment recommendations

- Cardiac catheterization results: If performed to evaluate valve severity

- Exercise stress test: Demonstrating functional capacity and symptom response

- Surgical reports: Complete operative notes if valve replacement or repair performed

“Our most successful strategy involves submitting comprehensive cardiac records upfront rather than waiting for underwriter requests. This demonstrates transparency and often results in faster decisions with better rate classifications.”

– InsuranceBrokers USA – Management Team

Rate Classification Possibilities

Understanding potential outcomes helps set realistic expectations. For guidance on pre-existing health conditions more broadly, see our comprehensive guide on life insurance for high-risk individuals:

- Standard rates: Available for asymptomatic individuals with normal valve function

- Standard plus (table ratings): Common for mild valve dysfunction without symptoms

- Substandard ratings: Applied when moderate dysfunction or symptoms are present

- Postponement: Requested when a recent surgery or unstable condition requires a waiting period

- Declination: Reserved for severe valve disease or significant complications

How to Apply Successfully for Coverage?

Strategic application preparation significantly improves your chances of obtaining favorable coverage terms. Our recommended approach involves thorough preparation, timing considerations, and professional guidance.

Pre-Application Preparation

Before submitting any application, ensure you have current medical documentation that presents your condition favorably:

- Schedule a recent cardiac evaluation: Obtain an echocardiogram within 6 months of application

- Gather comprehensive records: Collect all relevant cardiac testing and consultation notes

- Document symptom status: Prepare a clear explanation of the current activity level and absence of symptoms

- List medications accurately: Include dosages and prescribing physicians for all cardiac medications

Bottom Line

Applications submitted with current cardiac testing and comprehensive medical records receive faster processing and more favorable consideration than incomplete submissions.

Choosing the Right Insurance Company

Different insurers have varying approaches to cardiac conditions. Consider these factors when selecting companies to approach:

- Cardiac underwriting expertise: Some companies specialize in heart condition evaluations

- Rate competitiveness: Premium variations can be significant between companies

- Coverage amount flexibility: Maximum issue limits vary by insurer

- Underwriting timeline: Processing speeds differ substantially

Application Timing Considerations

Strategic timing can impact your approval odds and rate classification:

- Post-surgical applications: Wait a minimum of 3-6 months after valve surgery for optimal consideration

- Stable condition periods: Apply when cardiac status has been stable for at least 12 months

- Age considerations: Younger applicants often receive more favorable treatment for congenital conditions

- Health optimization: Address controllable risk factors (blood pressure, cholesterol) before applying

Key Takeaways

- Current medical records are essential for favorable underwriting decisions

- Company selection significantly impacts both approval odds and premium costs

- Professional guidance helps navigate complex underwriting requirements

- Timing applications during stable periods improves outcome potential

What Will Life Insurance Cost with a Bicuspid Aortic Valve?

Premium costs vary significantly based on valve function, symptoms, and treatment history. Understanding cost factors helps you budget appropriately and evaluate different coverage options.

Estimated Monthly Premiums – $500,000 Term Life Insurance

| Age/Gender | Standard Rates | Mild Dysfunction | Moderate Issues |

|---|---|---|---|

| Male, Age 35 | $35-45 | $50-70 | $85-120 |

| Female, Age 35 | $28-38 | $42-58 | $70-95 |

| Male, Age 45 | $65-85 | $95-130 | $150-200 |

| Female, Age 45 | $48-65 | $72-95 | $110-145 |

Factors Affecting Premium Costs

Key insight: Premium variations of 200-300% are common between best and worst-case scenarios for the same individual, depending on underwriter assessment and company selection.

- Valve function severity: Normal function may qualify for standard rates, while moderate dysfunction typically results in table ratings

- Symptom presence: Asymptomatic individuals receive significantly better rates than those with exercise limitations

- Age at application: Younger applicants often receive more favorable treatment for congenital conditions

- Overall health profile: Additional risk factors compound cardiac condition impact

- Coverage type selected: Term insurance typically offers lower premiums than permanent coverage

Cost Comparison Strategies

Effective premium shopping requires understanding how different companies evaluate your specific situation:

- Multiple company quotes: Premium variations of 50-100% are common between insurers

- Coverage amount optimization: Some companies offer better rates at higher coverage levels

- Term length consideration: Longer terms may provide better value despite higher initial premiums

- Rider evaluation: Additional living benefits riders may be worth considering, given cardiac risk

Bottom Line

Individuals with a bicuspid aortic valve and normal valve function can often secure life insurance at standard rates, while those with mild dysfunction typically face 25-50% premium increases above standard pricing.

Which Insurance Companies Offer the Best Options?

Insurance company selection significantly impacts both approval likelihood and premium costs for individuals with a bicuspid aortic valve. Our analysis of underwriting practices reveals distinct advantages with certain carriers.

Companies with Favorable Cardiac Underwriting

Based on our experience with hundreds of cardiac applications, these companies demonstrate more favorable approaches to bicuspid aortic valve cases:

- Prudential: Excellent track record for asymptomatic cases with normal valve function

- Lincoln Financial: Competitive rates for mild valve dysfunction without symptoms

- Principal Financial: Strong consideration for younger applicants with congenital conditions

- Mutual of Omaha: Flexible underwriting for cases with stable surgical outcomes

- Protective Life: Good options for no-exam policies when traditional underwriting proves challenging

“We’ve found that Prudential and Lincoln Financial consistently offer some of the most competitive rates for bicuspid aortic valve cases where valve function remains normal. However, company preferences can vary significantly based on specific medical details, making professional evaluation essential.”

– Insurance Brokers USA Team, Cardiac Underwriting Specialists

Specialized Coverage Options

When traditional coverage proves challenging, these companies offer alternative products worth considering:

- Simplified Issue Options: AIG, Foresters, and SBLI offer reduced medical requirement policies

- Guaranteed Issue Coverage: Available through multiple carriers for immediate protection needs

- Group Coverage Enhancement: Consider supplementing employer benefits with additional group life insurance or individual policies

Companies to Approach with Caution (in our humble opinion)

While not necessarily poor choices, these companies typically apply stricter underwriting to cardiac conditions:

- Northwestern Mutual (very conservative cardiac underwriting)

- New York Life (limited flexibility for valve conditions)

- MetLife (historically strict on congenital heart conditions)

Key Takeaways

- Company selection can result in 50-100% premium variations for identical coverage

- Some insurers specialize in cardiac condition underwriting with more favorable outcomes

- Professional guidance helps identify the best companies for your specific situation

- Multiple applications may be necessary to secure optimal terms

What Mistakes Should You Avoid During the Application Process?

Common application errors can result in declined coverage or unnecessarily high premiums. Understanding these pitfalls helps ensure the best possible outcome for your situation.

Documentation and Medical Record Mistakes

Inadequate medical documentation represents the most common reason for unfavorable underwriting decisions:

- Outdated cardiac testing: Submitting echocardiograms older than 12 months raises underwriter concerns about the current status

- Incomplete medical records: Missing cardiology consultation notes or surgical reports delay processing and create unfavorable impressions

- Inconsistent information: Contradictory details between the application and medical records trigger additional scrutiny

- Unclear symptom description: Vague statements about activity tolerance rather than specific functional assessments

Bottom Line

Complete, current medical documentation submitted upfront prevents delays and demonstrates transparency that underwriters view favorably.

Application Timing Errors

Poor timing decisions significantly impact approval chances and premium outcomes:

- Applying too soon after diagnosis: Underwriters prefer seeing stable condition management over 6-12 months

- Post-surgical applications: Applying immediately after valve repair or replacement, rather than waiting for a full recovery assessment

- During symptom changes: Submitting applications when experiencing new or worsening symptoms

- Without optimal health management, Failing to address controllable risk factors before applying

Company Selection Mistakes

Key insight: Choosing the wrong insurance company can result in unnecessary declinations that appear on industry databases, potentially affecting future applications.

- Single company approach: Applying to only one insurer without understanding their cardiac underwriting practices

- Premium-only focus: Selecting companies based solely on advertised rates rather than underwriting philosophy

- Ignoring specialty programs: Overlooking insurers with specific expertise in cardiac conditions

- Rushing the process: Submitting multiple simultaneous applications without strategic planning

“One of the biggest mistakes we see is applicants attempting to handle complex cardiac cases without professional guidance. The difference between a declined application and standard rates often comes down to strategic company selection and proper medical record presentation.”

– InsuranceBrokers USA – Management Team

Communication and Disclosure Errors

Honest, complete disclosure builds trust with underwriters and prevents policy complications:

- Minimizing condition severity: Downplaying symptoms or functional limitations

- Omitting related conditions: Failing to mention associated heart rhythm issues or other cardiac problems

- Incomplete medication lists: Not disclosing all cardiac medications or dosage changes

- Poor communication with medical examiners: Providing inconsistent information during required medical exams

Key Takeaways

- Complete, current medical documentation prevents most application delays

- Strategic timing improves both approval odds and rate classifications

- Professional guidance helps avoid costly company selection mistakes

- Honest disclosure builds underwriter confidence and prevents future complications

Frequently Asked Questions

Can I get life insurance with a bicuspid aortic valve if I haven’t had surgery?

Yes, absolutely. Many individuals with a bicuspid aortic valve who haven’t required surgical intervention can qualify for standard or near-standard life insurance rates. The key factors are normal valve function, absence of symptoms, and stable cardiac testing results. Our experience shows that asymptomatic individuals with normal or mildly abnormal valve function often receive favorable underwriting decisions.

How long should I wait after valve surgery before applying for life insurance?

Generally, 3-6 months minimum, with 12 months being optimal. Insurance companies want to see successful surgical recovery and stable post-operative cardiac function before making underwriting decisions. Applications submitted too early often result in postponement requests, while waiting allows you to demonstrate stable surgical outcomes that underwriters view favorably.

Will having a bicuspid aortic valve automatically disqualify me from certain insurance companies?

No automatic disqualifications exist, but company preferences vary significantly. Some insurers specialize in cardiac condition underwriting and offer more favorable terms, while others apply stricter guidelines. This is why professional guidance in company selection proves valuable – matching your specific situation with insurers known for favorable cardiac underwriting substantially improves outcomes.

Should I mention my bicuspid aortic valve if I have no symptoms and normal valve function?

Yes, complete honesty is essential and legally required. Failing to disclose known medical conditions can void your policy when your beneficiaries need it most. However, an asymptomatic bicuspid aortic valve with normal function often receives favorable underwriting consideration. The key is presenting your condition accurately with supporting medical documentation.

What medical records should I gather before applying for life insurance?

Collect comprehensive cardiac documentation, including recent testing. Essential records include your most recent echocardiogram (within 12 months), cardiology consultation notes, any cardiac catheterization results, exercise stress test results if performed, and complete surgical reports if applicable. Having these records ready demonstrates preparation and often speeds the underwriting process.

Can I get coverage if other insurance companies have previously declined me?

Yes, previous declinations don’t prevent future approvals with different companies. Insurance companies have varying underwriting guidelines and risk tolerance levels. A declination from one company doesn’t mean others will reach the same decision. However, you must disclose previous declinations on future applications, making professional guidance valuable for strategic company selection.

Is guaranteed issue life insurance a good option for a bicuspid aortic valve?

Guaranteed issue should be a last resort due to high costs and limited benefits. These policies typically offer small coverage amounts ($25,000 or less), charge significantly higher premiums, and include two-year waiting periods for natural death benefits. Most individuals with a bicuspid aortic valve can qualify for better traditional coverage options, making guaranteed issue unnecessary except in severe cases.

How much life insurance can I typically get with a bicuspid aortic valve?

Coverage amounts depend on your valve function and overall health status. Individuals with normal valve function and no symptoms can often qualify for standard coverage limits (up to $5 million or more based on income). Those with mild valve dysfunction may face reduced maximum limits, while severe cases might be limited to smaller coverage amounts through specialized products.