In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after being diagnosed with Dubin-Johnson Syndrome

Questions that will be directly addressed will include:

- Can I qualify for life insurance if I have been diagnosed with Dubin-Johnson Syndrome?

- Why do life insurance companies care if I’ve been diagnosed with Dubin-Johnson Syndrome?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- What can I do to help ensure that I get the “best life insurance” for me?

So, without further ado, let’ dive right in!

Can I qualify for life insurance if I have been diagnosed with Dubin-Johnson Syndrome?

Yes, individuals who have been diagnosed with Dubin-Johnson Syndrome can and often will be able to qualify for a traditional term or whole life insurance policy. In fact, they may even be able to qualify for a no exam term life insurance policy at a Preferred rate!

Why do life insurance companies care if I’ve been diagnosed with Dubin-Johnson Syndrome?

What you’re generally going to find is that most life insurance companies aren’t going to “care” all that much about the fact that you have been diagnosed with Dubin-Johnson Syndrome because at the end of the day, despite the fact that Dubin-Johnson Syndrome is a rare, autosomal disease it’s not one that causes an individual to develop any serious symptoms or consequences.

That said however…

What can cause a life insurance company to “worry” is the fact that an individual who does suffer from Dubin-Johnson Syndrome can sometimes develop jaundice, which is a condition in which the skin, whites of the eyes and mucous membranes turn yellow due to high levels of bilirubin within the blood.

Now…

The main reason why this is going to make a life insurance company a “bit” nervous is that aside from Dubin-Johnson Syndrome, many of the other reasons why an individual might develop jaundice can be quite serious. Reasons such as:

- Hepatitis,

- Gallstone attack,

- Tumors,

- Etc…

This is why…

Even though a life insurance company may not care about the fact that you have been diagnosed with Dubin-Johnson Syndrome, they’re still likely to ask you a few questions about it just to make sure that you’re not also suffering from some other “kind” of pre-existing medical condition which could also be causing your jaundice as well.

Dubin-Johnson Syndrome Defined:

Dubin-Johnson Syndrome is a rare, autosomal recessive disease that causing one’s body to accumulate an increased amount of conjugated bilirubin in the serum. A tale-tell sign that one may suffer from this syndrome will be that over time their liver will actually turn black due to the deposition of black pigment within the actual cells making up the liver.

Fortunately…

Dubin-Johnson Syndrome is a benign condition which frequently won’t cause one to suffer too many complications other than the occasional bout of jaundice. And while suffering from jaundice can cause one to suffer from:

- Abdominal pain,

- Nausea and/or vomiting,

And fatigue, it’s unusual for any of these to become too severe, which is why most life insurance companies are not going to be too concerned about them.

Now at this point…

We usually like to take a moment and remind folks that nobody here at IBUSA has any “official” medical training, and we’re certainly not doctors. All we are is a bunch of life insurance agents who just happen to be really good at helping folks with pre-existing medical conditions like this one, find and qualify for the life insurance coverage that they are looking for.

But…

Not so great if you’re looking for answers to any specific medical questions. In cases like these, we would recommend that you contact a true medical professional who has the training to help. For everyone else, you’re in luck because now we’re going to get into some of the “nitty-gritty” about what you may or may not be able to qualify for.

What kind of information will the insurance companies ask me or be interested in?

Common questions you’ll likely be asked may include:

- When were your first diagnosed with Dubin-Johnson Syndrome?

- Who diagnosed your Dubin-Johnson Syndrome?

- How often (if ever) do you experience jaundice as a result of your condition?

- Have you been diagnosed with any other pre-existing medical conditions?

- Are you currently taking any prescription medications?

- Are you currently working now?

- In the past 12 months, have you applied for or received any form of disability benefits?

What rate (or price) can I qualify for?

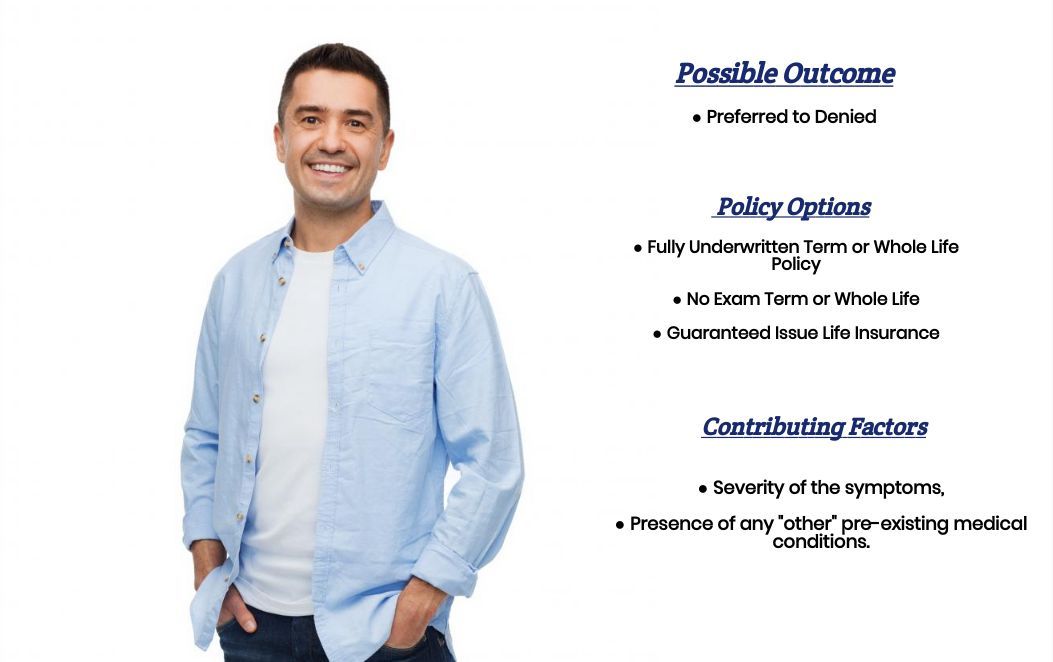

Generally, what we have found in the few cases where we have actually worked with someone who has been diagnosed with Dubin-Johnson Syndrome is that, for the most part, most life insurance companies aren’t going to pay this disease or syndrome much attention.

And in cases…

Where an insurance underwriter might ask a few questions, it’s usually just to make sure that if you do suffer from an occasional bout of jaundice that it’s first due to your Dubin-Johnson Syndrome and not from so other pre-existing medical condition and that the symptoms associated with your jaundice doesn’t prevent you from being able to live a “normal” life.

Once that’s been…

Established what you’re usually going to find is that whatever rate you would have been able to have qualified for PRIOR to being diagnosed with Dubin-Johnson Syndrome should be the same rate that you would be able to qualify for AFTER having been diagnosed with Dubin-Johnson Syndrome!

“Which is great!”

And it is a perfect segue into our next topic which is…

What can I do to help ensure that I get the “best life insurance” for me?

In our experience here at IBUSA, what we have found that works best for folks who have been diagnosed with a pre-existing medical condition where the “severity” of the condition is often “subjective” is for the applicant to make sure that they first find a true-life insurance professional who will work as an advocate for you.

Such an agent…

Will not only help guide you through the application process but also be perfectly “frank” with you about what options may or may not be possible for you.

From there…

You’ll also want to make sure that the very same agent you have chosen has access to dozens of different life insurance companies because after all, it really doesn’t matter how “great” of a life insurance agent you might have if they don’t have access to the “best” life insurance policy for you! Now, does it?

Lastly…

You’ll want to make sure that you’re completely honest with your life insurance agent prior to applying for coverage. By doing so, you will be helping him or her narrow down what options might be the “best”.

So, what are you waiting for? Give us a call today and see what we can do for you!

Now, will we be able to help out everyone who has been previously diagnosed with Dubin-Johnson Syndrome?

No, probably not. But what we can tell you is that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Burial Life Insurance Companies as well so that in the event that someone isn’t able to qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.