Colonial Penn is a well-known company that provides burial insurance and final expense insurance. However, some individuals may question whether Colonial Penn burial insurance is a reliable option. In this Colonial Penn review, we will examine the various products offered by the company, their pricing, and potential alternatives if Colonial Penn does not meet your needs, goals, and budget.

Compare over 50 top life insurance companies instantly.

|

Review of Colonial Penn

There are quite a few options available when considering different final expense life insurance companies. To knowledgeably choose between the available products you need to know what’s out there and understand the strengths and weaknesses of the various policies and companies.

What is Final Expense Insurance?

Final expense insurance, also known as funeral insurance or burial insurance, is a form of senior whole life insurance that provides cash to cover the high costs associated with memorial services and the disposition of the deceased’s final remains.

In addition, larger policies can also serve as a source of funds to pay off estate debts and taxes, administrative fees, and other transaction costs incurred during the estate administration process. By guaranteeing the availability of cash, final expense insurance prevents situations where grieving loved ones must bear significant financial obligations, or where the executor of the estate must sell non-liquid assets at a loss to cover funeral and burial expenses.

Cash Value Whole Life Insurance

Final expense insurance typically consists of permanent whole life insurance, with fixed premiums and coverage that never lapses as long as premiums are paid.

Eligibility for final expense insurance is generally restricted to older applicants, and the available coverage levels are usually limited to smaller whole life insurance policies of $25,000 or less.

The application process is typically less complicated, and underwriting standards are less stringent compared to most other life insurance products. As a result, burial insurance can be an excellent option for seniors who might otherwise have difficulty qualifying for affordable life insurance coverage.

About Colonial Penn:

Colonial Penn Life Insurance Company is a Pennsylvania-based insurer that specializes in final expense policies with relatively low coverage amounts and limited underwriting requirements.

Established in 1967 by one of AARP’s co-founders, Leonard Davis, Colonial Penn has an A- (or “Excellent”) rating from A.M. Best, indicating that it is financially stable, although not as strong as some of the industry’s more established giants.

Colonial Penn is perhaps best known for its high-profile paid spokespersons, including NFL greats Joe Theissmann and Roger Staubach, former Johnny Carson sidekick Ed McMahon, and the current face of the company, Jeopardy host Alex Trebek.

Consumer organizations have rated Colonial Penn’s performance as average to subpar. The Better Business Bureau has given the company an A+ rating, but there have been 79 consumer complaints. Nevertheless, it is encouraging to note that the company is actively addressing these complaints on the BBB website.

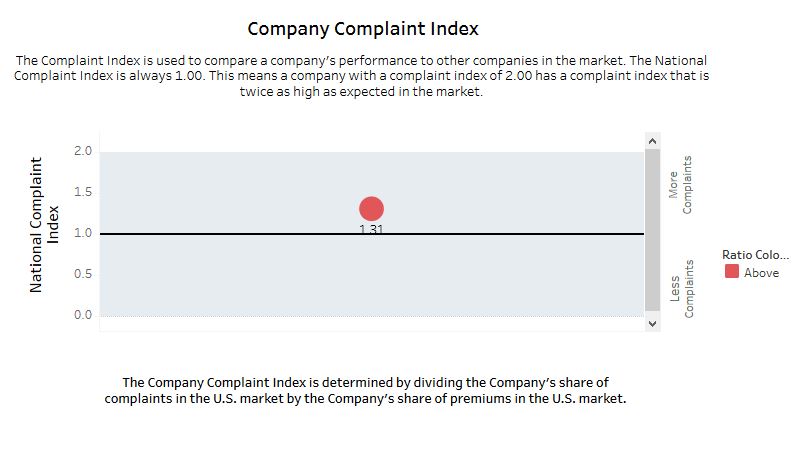

NAIC Company Complaint Index Rating for Colonial Penn

Colonial Penn rates slightly higher than its competitors with a NAIC company complaint index rating of 1.31.

Colonial Penn’s Final Expense Insurance Products:

Colonial Penn’s Final Expense Insurance Products:

Let’s take a moment and discuss the different products offered by Colonial Penn.

Colonial Penn Guaranteed Acceptance Whole Life

Colonial Penn’s flagship policy is the Guaranteed Acceptance Whole Life. This policy is the company’s most commonly issued one and is the focus of most of their advertising efforts.

The policy provides guaranteed-issue whole life insurance coverage with fixed premiums and death benefits that remain in place for the insured’s lifetime, as long as premiums are paid.

Available coverage amounts vary based on the applicant’s age and gender and are generally low. As a result, the coverage levels may not be suitable for applicants who are seeking life insurance as a source of income replacement. However, for final expense insurance, the benefit levels are usually adequate.

The application process for Guaranteed Acceptance Whole Life is simple and does not require a health physical or any medical questions. As long as an applicant is within the policy’s covered age range (50-85) and does not reside in the State of New York, the application will not be rejected.

Colonial Life Guaranteed Acceptance Life Insurance Rates

Colonial Penn has a unique system for measuring coverage amounts for its Guaranteed Acceptance policies.

Most life insurance companies offer different levels of coverage and then base the premium rates for each coverage level on the insured’s age, sex, and medical history (except medical history is not considered for guaranteed acceptance policies).

The available coverage limits stay the same, and the premiums are adjusted between applicants. That method is the norm in the industry and what Colonial Penn uses for its Renewable Term and Permanent Whole Life products.

Cost Per Unit

For Guaranteed Acceptance policies, though, Colonial Penn’s approach is to sell coverage by the “unit,” adjusting the amount of coverage per unit according to the applicant’s age and sex.

So, the premium price per unit stays consistent between applicants, but the benefit level per unit is adjusted.

Units of Guaranteed Acceptance policies cost $9.95 per month each, and applicants can purchase up to 12 units.

Now, most Colonial Penn reviews will state that you can only get 8 units. However, using Colonial Penn’s Quoter, the company offers up to 12 units for its Guaranteed Acceptance Whole Life Insurance.

We also double checked with a Colonial Penn representative who affirmed that you can get up to 12 units of coverage.

So if you qualify based on your age, everyone can get up to 12 units, with each unit costing $9.95 a month. 12 units multiplied by $9.95 equals a total price tag of $119.40.

For example, a 50 year old male wanting 12 units of coverage would qualify for $21,432 worth of life insurance.

However, a 60 year old male wanting 12 units of coverage would qualify for $14,568 worth of life insurance.

Further, a 70 year old male wanting 12 units of coverage would qualify for $8,604 worth of life insurance.

Finally, an 80 year old male wanting 12 units of coverage would qualify for $5,112 worth of life insurance.

You can compare this to what other burial insurance companies offer $25,000 whole life policies and $10,000 whole life insurance policies for. In most instances you will find that a lower cost options exists vs Colonial Penn.

Making Sense of Colonial Penn’s Pricing

Ultimately, what this means is that a 50-year-old male and an 80-year-old male could each purchase 12 units of coverage for the exact same premium ($119.40), but the 50-year-old male would receive a much higher coverage amount per unit.

The effect of this model is that the maximum whole life insurance coverage limits available from Colonial Penn vary considerably by applicant.

Younger applicants can purchase more coverage, and older applicants are limited to a few thousand dollars.

There’s a lot of flexibility in deciding how much you will spend on premiums because you have eight different levels to choose from.

But, particularly for older applicants, you may not be able to get as much coverage as you would like, even if you are willing to pay higher premiums.

Twelve units is the maximum across the board.

Colonial Penn Permanent Whole Life Insurance

Colonial Penn Life Insurance Company also offers a Permanent Whole Life Insurance product, which is another option for permanent life insurance suited to funeral and burial costs.

This product is a simplified issue policy, meaning that there is no medical exam required, but applicants will have to complete a written health screening. Coverage can be declined for applicants with existing health problems.

Available to applicants between the ages of 40 and 75 in every state except New York, Permanent Whole Life from Colonial Penn offers coverage limits ranging from $10,000 to $50,000. This is a fairly typical range for final expense insurance, and unlike the Guaranteed Acceptance policy, Permanent Whole Life does not require a waiting period.

Both of Colonial Penn’s whole life offerings – Guaranteed Acceptance and Permanent Whole Life – accrue cash value after a policy has been in place for a year. The value builds up over time and can be borrowed against as an emergency cash source. However, policy loans accrue interest at a high rate of eight percent, and any outstanding loan balance at the time of the insured’s death will be deducted from the death benefit.

Colonial Penn Renewable Term Life Insurance

Colonial Penn offers Renewable Term Life Insurance as its third final-expense life insurance option. The policy provides up to $50,000 in term coverage for eligible applicants aged 18 to 75 in every state except New York and Montana.

While term life insurance policies have lower starting premiums compared to whole life policies with comparable coverage levels, they do not have long-term fixed premiums and do not accrue cash value. The $50,000 maximum coverage level offered by Colonial Penn is low by term life standards.

However, Colonial Penn’s term coverage is guaranteed renewable through age 90, which is notably higher than most term policies. Keep in mind that life insurance premiums increase every five years, sometimes dramatically. By the time insureds reach their 80s, premiums cost much more than a whole life policy purchased earlier in life and are no longer affordable for many policyholders. If an insured lives past age 90, the term coverage lapses altogether, at which point the premiums are gone, and the insured no longer has life insurance coverage.

If the objective is to provide a source of cash for final expenses, a term policy is not certain to do that.

Applying for Colonial Penn Final Expense Life Insurance:

Colonial Penn offers two final expense insurance options, Permanent Whole Life and Renewable Term, that require applicants to complete a health questionnaire, but no physical exam is needed. The company may also conduct a prescription history report and may require a telephone interview.

However, Colonial Penn has strict underwriting standards for its medically screened policies. There is a long list of disqualifying medical conditions, which includes being recently hospitalized, using a wheelchair or oxygen, having diabetes or bipolar disorder, and other significant conditions. These circumstances make the applicant ineligible for Colonial Penn’s medically screened policies.

It is important to note that the underwriting process varies among life insurance companies, and not all insurers screen for the same conditions. Therefore, some circumstances that would disqualify an applicant for Colonial Penn’s policies may be acceptable for other top life insurance companies.

Colonial Penn’s Guaranteed Acceptance policy does not require any medical screening. However, like most guaranteed acceptance life insurance policies, it has a mandatory two-year waiting period.

It is worth noting that Colonial Penn’s Permanent Whole Life and Renewable Term policies have higher coverage limits than the Guaranteed Acceptance policy. While the Guaranteed Acceptance policy has fixed premiums and death benefits that stay in place for the insured’s lifetime, it may not be sufficient for those who want life insurance as a source of income replacement.

Colonial Penn’s Waiting Period:

Colonial Penn offers both Renewable Term and Permanent Whole Life Insurance policies, which are both considered “immediate issue life insurance” policies. This means that the full benefit amounts become effective as soon as the policy is issued.

On the other hand, Guaranteed Acceptance has a two-year waiting period, also known as the “limited benefit period,” which means that if the insured dies during this period, the full policy benefits will not be paid to the named beneficiary.

Instead, Colonial Penn will refund all premiums paid to date plus seven percent interest. However, compared to other insurers that offer guaranteed acceptance funeral insurance, the seven percent interest on returned premiums paid by Colonial Penn is on the low side.

It’s worth noting that the waiting period is not applicable if the insured dies during the “limited benefit period” due to a bona fide accident. Deaths resulting from illness, suicide, healthcare treatment, voluntary ingestion of poison, or act of war do not qualify as “accidental.”

Colonial Penn Final Expense Insurance Premiums

Colonial Penn primarily bases premium rates for their final expense insurance policies on the applicant’s gender, age at the time of application, and desired benefit level. Younger female applicants generally receive the lowest rates.

While Colonial Penn emphasizes in their marketing materials that premiums for their whole life policies are locked in place for life, fixed premiums are standard for whole life coverage in general. Flexible premiums are the exception in the industry and are typically found in permanent life insurance policies.

As mentioned earlier, Colonial Penn’s Renewable Term policy, like any other term policy that can be renewed, does not have fixed premiums. As the insured gets older, the premiums increase. When the insured approaches their life expectancy, the increase can be dramatic.

In whole life insurance, a general rule of thumb is that guaranteed acceptance coverage is almost always more expensive than a comparable policy with medical underwriting. This is because the insurer has to assume the applicant is in worse health than average. Therefore, an applicant who qualifies for a health-screened policy will generally receive better life insurance rates than with comparable guaranteed issue coverage.

The purpose of guaranteed acceptance policies is to provide access to final expense life insurance to individuals who might not otherwise qualify. This is Colonial Penn’s specialty. Compared to other companies offering guaranteed whole life policies, Colonial Penn’s rates are average to above-average in cost.

Colonial Penn offers policyholders flexibility in how they choose to pay premiums. Payments can be made monthly, quarterly, semi-annually, or annually. In most cases, the company offers a discount equal to one month’s premium for policyholders who opt to make annual payments.

Final thoughts…

While Colonial Penn may offer a range of final expense life insurance options, including whole life and term policies, as well as guaranteed acceptance coverage, it’s important to remember that no single insurer is the best fit for everyone. While Colonial Penn’s premiums may be competitive for some applicants, they may be higher than other insurers for others. Similarly, while the company’s underwriting guidelines may be more lenient in some areas, they may be more strict in others.

It’s important to shop around and compare policies from multiple insurers before making a final decision. Consider factors such as premium rates, coverage levels, underwriting requirements, and customer service ratings. By doing your research and comparing multiple policies, you can feel confident that you’ve selected the right final expense life insurance policy for your needs and budget.