In this article, we wanted to take a moment to answer some of the most common questions we get from folks applying for life insurance after they have been prescribed Ambien or its generic form, Zolpidem, to treat their insomnia.

Questions that will be directly addressed will include:

- Can I qualify for life insurance after I’ve been prescribed Ambien?

- Why do life insurance companies care if I’ve been prescribed Ambien?

- What kind of information will the insurance companies ask me or be interested in?

- What rate (or price) can I qualify for?

- How can I help ensure I get the “best life insurance” for me?

So, without further ado, let’s dive right in!

Can I qualify for life insurance after I’ve been prescribed Ambien?

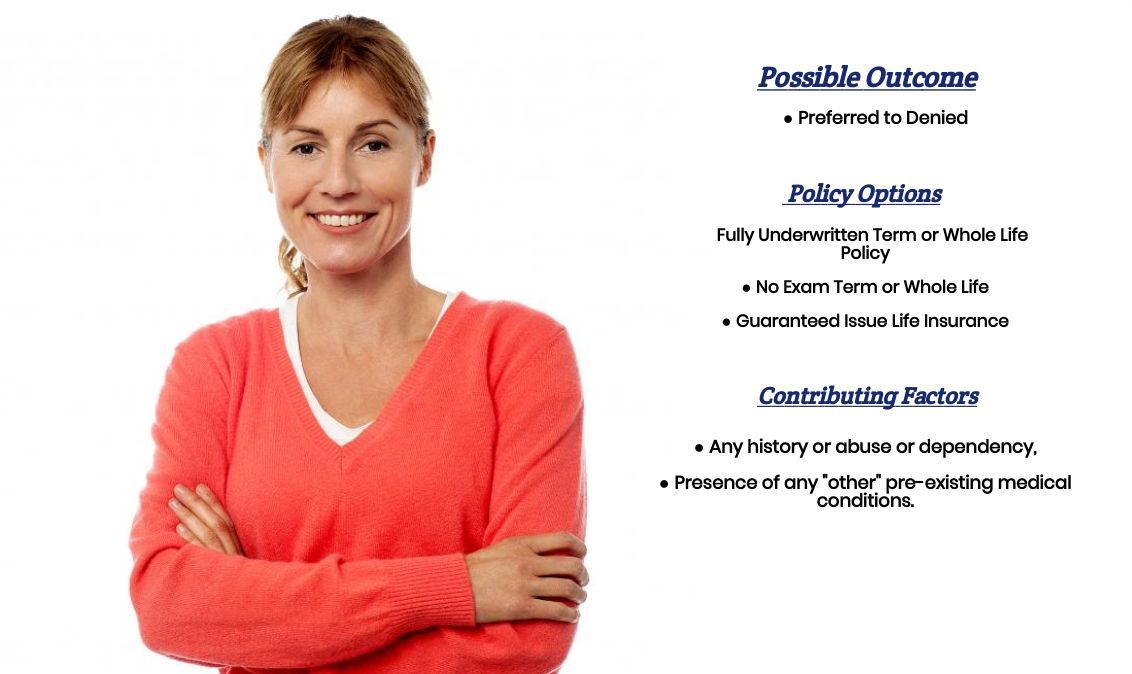

Yes, you can certainly qualify for life insurance after being prescribed Ambien. Some may even be able to qualify for some of the best no-medical-exam life insurance policies at a Preferred rate!

The only problem is there is a chance that you can also be denied coverage because of your Ambien use as well! You see, while Ambien isn’t a medication that is used to treat a life-threatening medical condition, its use (or should we say abuse) can, in some situations, cause some of the best life insurance companies to become a bit “wary” of approving someone of coverage.

Why do life insurance companies care if I’ve been prescribed Ambien?

Life insurance companies only begin to take notice of someone’s “Ambien” use if it appears to have become an issue for them. You see, while it is true that Ambien is a “less addictive” alternative to many other sedative-hypnotic medications available to those hoping to treat their insomnia, it is still an addictive substance, and it can still be abused.

This is why one shouldn’t be surprised if an insurance underwriter asks a few questions about one’s Ambien use before approving or denying coverage.

What kind of information will the insurance companies ask me or be interested in?

Common questions one might be asked by an insurance underwriter regarding their Ambien use may include:

- When were you first prescribed Ambien?

- Who prescribed your Ambien to you? Your primary care physician or a specialist?

- How often do you take Ambien? Daily? Once or twice a week? Once or twice a month?

- Has your Ambien prescription changed over the past 12 months?

- Do you have any history of drug or alcohol abuse?

- Are you currently working now?

- In the past 12 months, have you applied for or received any disability benefits?

From here, we’ll generally have a pretty good idea about what “kind” of insurance you may or may not be eligible for and what rate you might be expected to pay. Additionally, here at IBUSA, we’ll have a pretty good idea of which insurance company may provide you with the best opportunity for success.

What rate (or price) can I qualify for?

The nice thing about having been prescribed Ambien is that assuming that you would otherwise be able to qualify for a Preferred or Preferred Plus rate, its presence shouldn’t affect the outcome of your application. That is, of course, assuming that you don’t present any signs of someone abusing this medication and would otherwise be able to qualify for such an “optimal” price point.

Because you see…

Just because having been prescribed Ambien in the past, or just because you currently use Ambien to treat your insomnia, won’t necessarily preclude you from being able to qualify for a Preferred Plus rate class doesn’t mean that there aren’t 100 other reasons that could!

For example…

Insurance companies use a wide variety of variables to determine whether or not someone may be able to qualify for a preferred rate. Variables ranging from ones:

- Height and weight ratio

- Family medical history

- Driving record

- Criminal background

- Travel preferences

- Hobbies

- Employment choices

- Etc…

This is why it’s important to understand why “certain” life insurance companies may be better for you personally than others.

How can I help ensure I get the “best life insurance” for me?

The most important thing an individual can do to increase their chances of buying the best life insurance policy they can qualify for is to “shop” their options. You see when it comes time to apply for life insurance. At the same time, there are a lot of great life insurance companies out there for folks with pre-existing medical conditions like insomnia; there are certainly some companies that are much “better” than others.

You see…

When deciding who an insurance company will and won’t insure, each company can make up its own rules/guidelines. As a result, you’re going to find that certain companies can “tend” to be more lenient regarding certain pre-existing medical conditions or lifestyle choices.

This is why it’s important to choose an insurance agency that has access to dozens of different life insurance companies so that in addition to just seeking out which company “might” be the “best” for you if you’ve been prescribed Ambien, they can also look for the “best life insurance” for you if you’ve been prescribed Ambien. You’re a little bit overweight too!

Now, can we help out everyone who has been prescribed Ambien?

No, probably not. But we can tell you that in addition to offering a wide variety of different term and whole life insurance policies, IBUSA has also worked very hard to establish relationships with many of the Best Final Expense Insurance Companies.

This way…

If someone can’t qualify for a traditional life insurance policy, chances are there may be some other “type” of product that you CAN qualify for.

So, if you’re ready to explore your options, call us!